Ukrainians now can safely entrust their money to banks without fear of losing them, be sure the leadership of the NBU. They believe that today almost all unreliable and suspicious banks liquidated — these are the results of three years activities of the regulator for cleaning the market. However, finanalytica differed in assessing cleaning: some say that halving the number of banks will benefit the country, while others see bankopada undermining confidence in the banking system of the country.

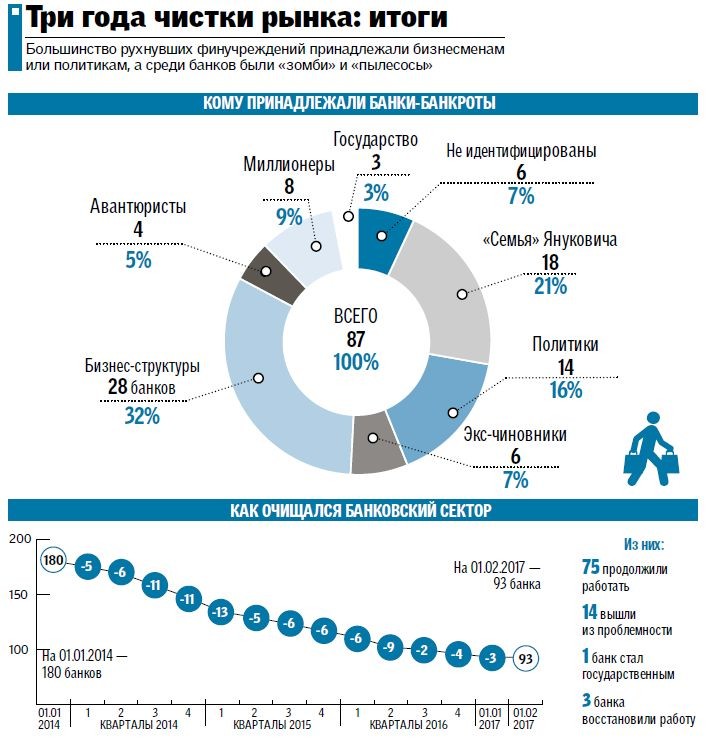

REPORT. As have informed us in a press-service of national Bank for 2014-2017 withdrawn from the market 87 troubled banks (in 2014 in Ukraine there were 180 banks), which was concentrated in 30% of the total assets. Recall applies to assets equity securities, deposits, etc. On the clarification of the NBU, withdrawn from the market primarily pseudorange: engaged in cashing in of money, in the pursuit of profit Finance riskier business projects and burned during the crisis, banks and financial pyramids and other dysfunctional (see infographic). “Now, investors can be sure that their money be returned on time and in full, work will start lending to small and medium businesses, the cost of (interest on) loans will be reduced, resistance of banks to macroeconomic shocks (crises) will increase, finally, became known the real owners of banks”, — assured the head of the NBU Valery Gontareva.

EXPERTS. Economist Ivan Nikitchenko noted that bankopad recent years is directly linked to the crisis of 2014-2015 “In those years, decreased quality (probability of repayment) of the loan portfolio, the customers started worse to pay the loans, many have ceased to serve them — analyzes Nikitchenko. All this led to the fact that the owners of the banks were obliged to deduct up to 100% of the loan amount in reserves of the NBU to mitigate risks. As a result, many banks became unprofitable, some of the shareholders have not found or did not want to pour money into banks, so they withdrew from the market”. Independent finanalitik Igor Shevchenko, on the contrary, says that the national Bank overzealous with the cleaning. “After so many bankruptcies, people are just afraid to trust money to banks — there is a loss of confidence in the banking system. The more that commercial banks with Ukrainian private capital remained only 2.5%, more than 40% — subsidiaries of banks with foreign capital, who seek to escape from our market, but I can’t, because there is no buyer. And 55% after the nationalization of “PrivatBank” — the state-owned banks,” said us Shevchenko.

FORECASTS. Experts agree that smaller banks will continue to withdraw from the market, but gradually — for the year no more than ten. This is indirectly confirmed by Deputy head of the NBU Kateryna Rozhkova, saying that identified five distressed banks, which may be eliminated. “How many banks will remain impossible to give a clear answer, the market will determine. In the neighboring European countries of their 50-80, Ukraine almost came to this figure. Therefore, people should still have deposits up to UAH 200 thousand in one Bank, choosing the state, the major structure or with foreign investors,” advises Nikitchenko. And Okhrimenko predicts a decrease in interest on deposits by 2-3% (below 15%) because of the state monopoly on Finance and absence of large lending caused by the crisis in the economy. “The national Bank destroyed the competition. In Germany, for example, about thousands of banks, most of them are small, working within one or more villages and tough competition. We can’t have it” — says Okhrimenko.