Voluntary motor insurance in Ukraine is gaining momentum. According to preliminary data, last year the volume of premiums collected in hull increased by 20%. The main reason was, of course, the growth in sales of new cars. Part of the machinery was purchased on credit or in installments from the shops, and to conclude an agreement in this case. And those who have purchased a new foreign car for “real” money, as a rule, the insurance does not save: the official service and repair a car today is expensive, and to drive a new thing in “crisis” HUNDRED as you do not want. In addition, in the process of attracting customers actively involved the insurers themselves. Car owners are no longer satisfied with the standard hull: people want more services and benefits, decide the risks and the deductible, looking for discounts for trouble-free and even change the style of driving.

SELECTION: CUT OFF THE “UNNECESSARY” OPTIONS

CASCO insurance policy provides insurance against various risks, and it’s not just the theft of or damage to the car in case of an accident. Depending on the insurance program to “protect” the car you can even from falling of icicles and break the glass hooligans, the damage cars the fault of the utility or in case of sudden expenditures (e.g., technical assistance on the road or the call of the emergency Commissioner). The theory of probability, these options can ever “shoot”, but to pay for “maybe” people no longer want.

“Clients are seeking to manage the cost of the purchased product due to the range of options, says the Director of the Department of affiliate sales and Bank IC “AXA Insurance” Alena Lipunova. — If you can, refuse the “extra” in their opinion, risks. Or choose a high deductible for events that, in their opinion, unlikely.”

“The policyholder carefully chooses the parameters of the policy to fit your preferences, — agrees the head of Department of development of insurance products and the application of the methodology JSIC “INGO Ukraine” Larisa Simonova. — For example, those who rarely gets into an accident their fault, prefer insurance with a high deductible for events that occurred through the fault of the client, and no deductible if the event is not associated with the actions of the insured. The size of the deductibles for such risks as “damage”, “total loss” and “theft” has a significant impact on the price of the policy. Therefore, the policies in different combinations there is a fixed deductible for individual risks, age limits car, a shortened list of the insured risks. For example, “Avtopragmatik” with the uniform rate of 1.85% protects only against the risks of total damage, total destruction or theft of the vehicle”.

A “Lite” insurance in certain variations offer today almost all the companies. Some insurers have started to work on the principle of “designer” — the customer selects only the most significant risks for themselves and pay only for them. “The policy without risk “and other random events” will be cheaper by 9%, without the risk of “misappropriation” by 11%. Exclude both risks and get savings of 20%, — said the speaker, IC “PZU Ukraine” Oleksandr Melnychuk. — You can make a policy aimed at the protection from a particular risk. For example, now the country dramatically increase in car thefts. But to insure only against theft is impossible: the minimal package of risks “stealing + accident”. In this accident you can set the maximum deductible is 5%, add the option “until the first insured event” (when the policy ends after the first payment. — Ed.) and to get a discount on the hull insurance policy almost 52%”.

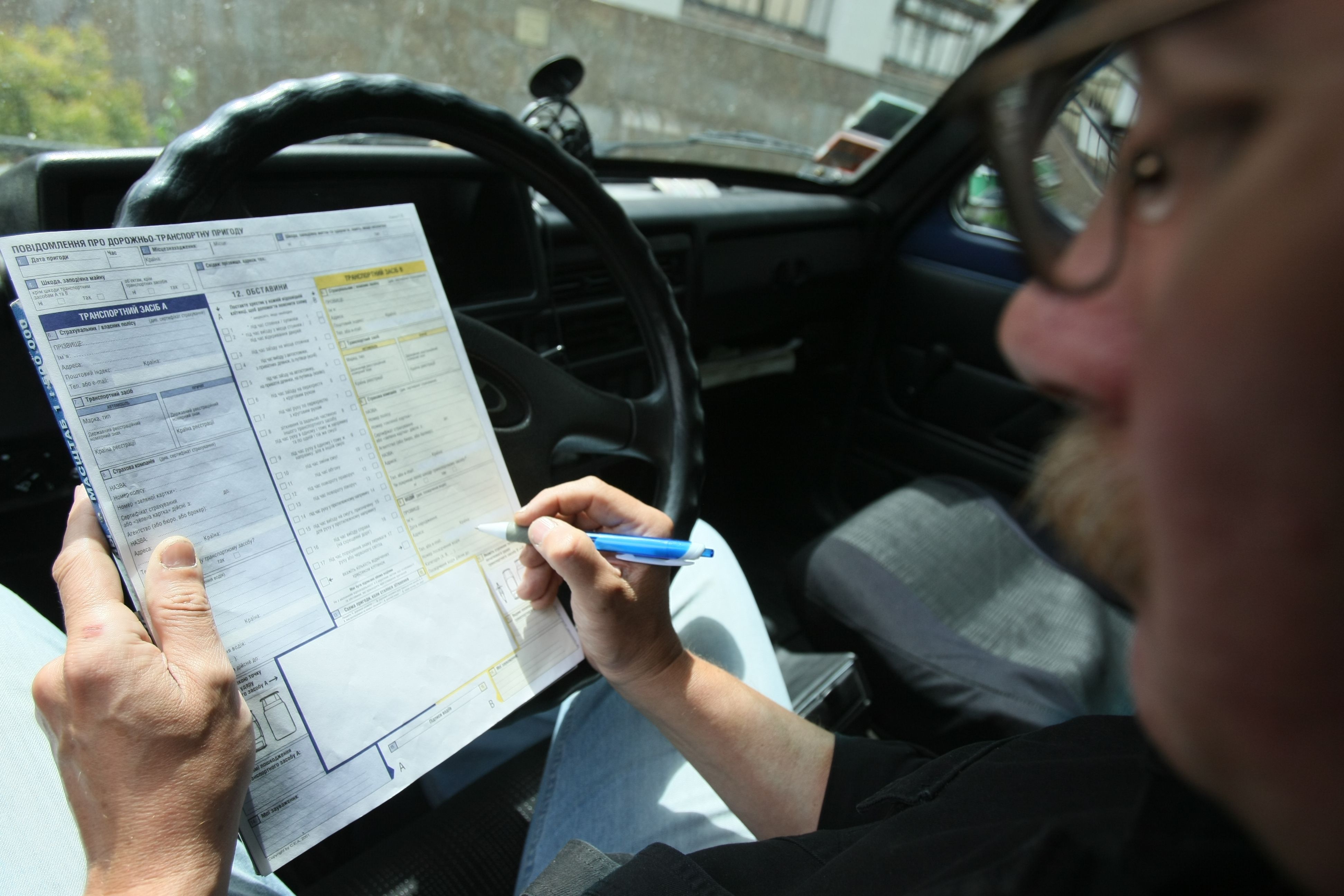

Insurance policy. Many offer a “Lite” version.

PROTECTIVE HULL: PAYING FOR PEACE OF MIND

Savings on individual risks is justified only if the owner deliberately goes to this step. “Even the size of the franchise we recommend you to select the client — this should be the amount that he can spend to restore a car without significant deterioration of its financial position,” — said Simonov. Also insurance companies have a pretty enticing offer to insure the car taking into account depreciation: hull will be cheaper by 30-60% (depending on car age). “And what will you say when the insurer compensates only 50% of your HUNDRED accounts, by applying the depreciation factor? Clearly the customer is dissatisfied. Because we don’t even offer this option. And to repair the coating without wear financial, apply multiplying factors. From 3 years there is a small increase, with 6 years it significantly and reaches the maximum to 14 years”, — says Deputy General Director SK “the Talisman Insurance” Asya Trubitskaya.

In General though insurers sell shorter versions of the hull, but is still campaigning for a “complete” product. First, money for the insurance they get more. But claims from clients in case of insured event will be less. The hull today is not what it used to be. It may include a number of topservice, ranging from free transportation of fuel and ending with health insurance for the driver and all passengers. “The majority of customers now again prefer a hull with a full set of insured risks, — says Melnychuk. — And if you want to save money, use deductible in case of partial damage. The difference in price between insurance with zero deductible and a deductible of 0.5% can reach 20-30%”.

Each insurer in the “full package” includes a set of chips. “Today, insurance companies are further increasing range of free services. For example, we have a towing service you can use not only in accidents but also in case of machine failure. On time auto repair we have within a certain limit are willing to provide a courtesy car or pay for taxi service. Among the popular services you can call the engine start when your battery is low, delivery of fuel or changing a wheel. The insurance Manager can have a turn in the road, book a hotel, find nearest gas station, or clinic” — lists Melnychuk.

BONUSES AND DISCOUNTS

Is it possible to keep the optimal set of options for hull, but still save money? . The first condition is to buy insurance directly in the company. Today, more and more insurers sell policies through the website and through the call center. “These sales channels provide an opportunity to minimize costs and to offer the best price,” explains Trubitskaya. “Work without agents allows the company to fully establish the reserves and make payments on the hull in 11 days,” — says the head of the Board of IC “Salamandra-Ukraine” Taras Vizina. You can try and faster: IC “VUSO” promises customers payment within a week and contracts “hull Stress” — “turbovblite” for 4 days.

The second condition, which will help to save your accuracy. Many companies offer drivers a discount of 10-30% for prolongation of the contract of insurance provided that during the previous period of insurance was not a single treatment. “This is a discount for trouble-free, — says Simonov. — If an experienced and careful driver seldom gets into an accident, we encourage him to stick to this style of driving. For example, the product “Auto 3+1″, the client pays for the policy is not right for the year ahead, and extend insurance coverage quarterly payment. If he goes 9 months without any accidents or claims to any loss, the insurance rate for him in the 4th quarter will be only 0.1. In fact, he gets 3 months full comprehensive insurance as a gift.” “PZU Ukraine” gives a discount of 10% for each loss-free year of insurance. Discounts can reach 50% (it will have to go without accidents in 5 years). “Is 5% cheaper insurance, if cars are only a husband and wife — says Melnychuk. — 7% less expensive insurance for the car, which for a year passes not more than 15 km. you can Also save by using alternative auto insurance, where there is a limit on the sum insured from 7 to 25 thousand UAH. Of course, full insurance, these don’t replace. This insurance option is suitable for cars aged 10 to 20 years, which at the moment on the hull, few insured.”

TELEMATICS — INSURANCE OF THE FUTURE

Another way to save money when buying CASCO associated with modern technology. In the world, more and more insurance companies use in their work with clients-motorists telematics device and the telematics is now called “insurance of the future.”

“The bottom line is this: the insured’s consent to auto set the device that synchronizes with the mobile phone of the driver and allows him to monitor their own driving style, explains Lipunova. Device marks a sharp acceleration, braking, or sudden maneuvers, speeding. All this is recorded in a database, and mobile application analyses your performance. For each there is a standard: for example, driving safely at 100 km needs to brake sharply not more than two times”.

The indicators are displayed on the screen of the phone in three colors: green, yellow and red. If the norm is complete, you in the green zone. If slightly exceeded, in yellow. If it is far from ideal, the color will be red. Thus, a person realizes their mistakes in a neat driving and he / she can work on the bugs. It is stimulated financially: according to Lipunov, the policy “hull Smart” with the installation of a telematics device is cheaper than 5%. Further payment under the contract is divided into 4 parts with paying every three months. Man drives three blocks, and the system all this time, analyzes his style of riding and assigns a certain number of points. To the device is possible not to pay attention at all, but would be much better to periodically check them and correct the deficiencies.

“If for three quarters of the driver showed a safe ride and earned more than 75 points, the last 25% of the total amount he pays, says Lipunova. — If you scored between 50 to 75 points, the final installment is paid but not in full. Thus, the total discount careful car owner for the first year of use “smart” hull will be up to 30%. By the end of the second year it may reach 40%, and the maximum discount for accident-free driving can reach 50% of the standard payment in the third year of insurance. Thus, we not only provide our clients with the ability to influence the cost of hull insurance, but help improve their driving style, helping to make it safer”.

“Smart” hull. Allows you to save up to 50%.