Over the past year, the level of shadow economy has decreased significantly, say in the Ministry of economic development. According to the rating of the international Association of chartered certified accountants (ACCA), Ukraine entered the top countries with the highest levels of the economy in the “shadow”. This figure depends on many factors: business confidence to power, the state of the economy, tax regulation. The website “Today” talked to experts and found out how Ukraine can reduce the level of shadow economy and who benefits from it.

The three “liderov”

The Ministry of economic development estimated that the level of the shadow economy in the past year fell by six percentage points and amounted to 34% of official GDP. However, even taking into account official estimates of the Ministry, a figure significantly above the global average. So, according to the calculations ACCA, 22,66% of global GDP is in shadow. Experts predict that gradually this percentage will decline to 21.4% in 2025.

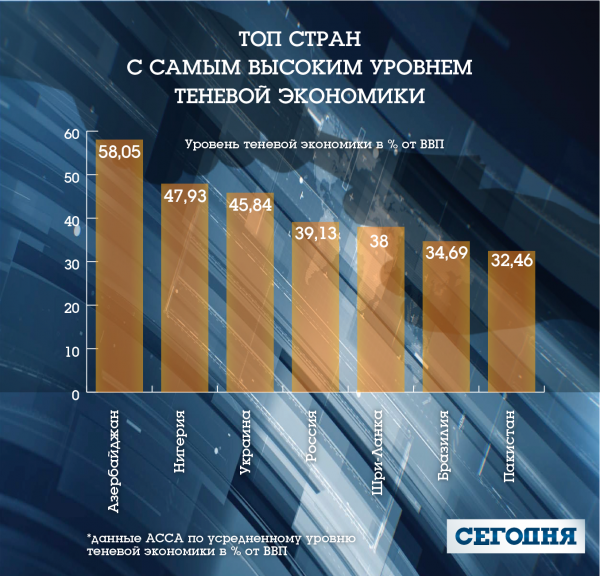

Calculations ACCA was for Ukraine is more pessimistic. So, Ukraine at the level of “shadow” inferior only two countries: Azerbaijan (58,05%) and Nigeria (from 47.93%). The economy of Russia, Sri Lanka, Brazil and Pakistan, according to the rating, was “whiter” Ukrainian.

According to the Ministry, over the past year, managed to bring part of the shadow economy due to the stabilization of the macroeconomic situation and reduce the load on the wage Fund. As you know, until last year, the average rate of single social contribution reached 37% of salary, and from January 2016 it reduced to 22%.

In the report the Ministry also notes that the closure of banks, the presence of uncontrolled territories, “the tension in international relations with Russia” and a low level of confidence in the institutions of government continues to hold the lion’s share of the Ukrainian economy in the shade.

Last year, during a meeting with Prime Minister Vladimir Groisman said that in the “shadow” is 1.1 trillion USD. Ethose remedies that “do not work for the Ukrainian state.”

The high level of economy in the”shadow” is, in particular, and great growth potential. So, at the end of this year the Ukrainian economy, experts predict the world Bank, will grow by about 2%, similar to the forecast voiced by the NBU. Potentially, if you bring the Ukrainian economy out of the “gray zone”, the growth rate of official GDP can be accelerated tenfold.

As the analyst of “Alpari” Maxim Parkhomenko, “shadow” economy starts small . The Ukrainians, who receive salaries in envelopes, are part of the “shadow” economy. In fact, not paying taxes, the “hands” you can get the amount more, however, these funds would go for infrastructure, education, health care, social policy of the state. The high level of “shadow” salaries is one reason for the poor Ukrainian pensions.

The more complex the situation in the economy – the more business goes into the shadows

The level of the “shadow” depends on the state of the economy as a whole, the candidate of economic Sciences Lydia Tkachenko. There is a pattern: in times of crisis – the level of “informal employment” is growing and when the economy is deregulating. For example, during the crisis of 2014 the level of shadow economy grew by a record seven percentage points and reached 42% of GDP. After a gradual growth in 2016 this figure has been reduced to 34%.

Photo: archive

Analyst Maxim Parkhomenko sure to improve the situation it is necessary to “restore order” in the tax legislation, reduce the number of regulatory bodies and to weaken rules that governs the exchange of capital.

“The fastest and best option to get the economy out from under the shadows – the state should create an environment where it is more profitable to do business and white without tax optimization. An example is the situation with the extraction of amber, is the legalization of this process, the government is tightening the screws the miners,” – says the expert.

“The fastest and best option to get the economy out from under the shadows – the state should create an environment where it is more profitable to do business and white without tax optimization. An example is the situation with the extraction of amber, is the legalization of this process, the government is tightening the screws the miners,” – says the expert.

One possible way to reduce the “shadow”, said General Director of audit company “Baker Tilly” Alexander Pochkun, – to establish effective levers of influence on business and to fight corruption. The expert notes that the business need to act “normal, civilized mechanisms of control.” According to Pochkun, the business will emerge from the “shadow” provided that work in the “white” will be more profitable.

The State fiscal service assured wages in the “shadow” primarily harm the Ukrainians themselves. The Director of the Department of revenue Paul Dronyak says: those who agree on the salary in “envelopes”, depriving themselves of a decent pension.

Why is it better to “white” salary

After the pension reform, the Ukrainians in order to retire at 60 years, from 2028, you must have at least 35 years of service. While teaching in universities in the period is not counted in 2004. Those who work without official registration, risk to retire at 63 or even 65 years. In addition, the pension depends on the size of the official salary. Ukrainian, which is decorated on the minimum wage, for zaslujennyi the rest will get the minimum pension. At the moment it is only 1312 hryvnia.

In addition, after the dismissal of the “by agreement of the parties” Ukrainian has the right to register with the employment Service and the first three months to obtain monthly assistance in the amount of his salary.

Photo: archive

Official registration by Labor code allows you to enjoy a number of rights. For example, the length of the working week should not exceed 40 hours, guaranteed lunch break, and on Fridays and before holidays, a shorter working day. In addition, according to the law, working Ukrainians have the right to vacation of 24 days, and if the leave is not used at dismissal to receive monetary compensation.

Also the formalization guarantee earnings not less than the minimum salary this year is 3200 UAH. Employers who violate the Labor code, are threatened with huge fines, says the head of the practice of conflict resolution and disputes JUSCUTUM Anton Kuts.

For example, if the employee is furnished at half rates, and in fact works full-time, employer can be fined for 96 thousand UAH (30 times the minimum wage). If you do not pay for extra work on weekends and after hours face a fine of $ 32 thousand hryvnia. By the way, any employee can complain to his boss who violate labor law, Fiscal service and labor Service. In addition, the government established an inter-Ministerial group whose task is to respond to such cases.