The primary real estate market today is in limbo: on the one hand, people in need of housing, is still a lot, as well as those who consider investing money in real estate a good investment. On the other – they are afraid to spend the accumulated, because of the constant decline in the price of residential meters is a high risk to be left with nothing: more construction projects in the country, freeze, and to anticipate it in advance is almost impossible.

“Today” figured out how things are going with the new building and what to expect investors before the end of the year. According to experts, the developers will actively seek partner banks that will lend to investors and to finish other people’s unfinished. But prices predicted to further slow the “melting”.

On the market see boom of assignments

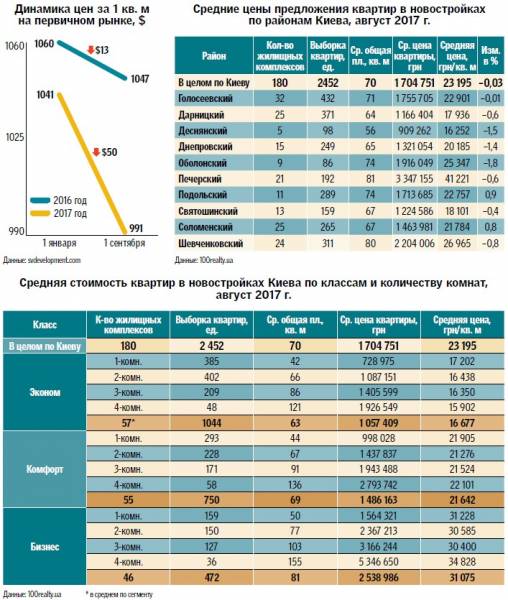

In August and September, according to analysts of the real estate market, continued to reduce the price of square meter in new buildings. This led to the fact that somehow, but the number of transactions grew, and at a stronger pace than in the same period last year. “In July 2016, were sold 403 apartments, and in August 364. In July, 2017 fixed 613 sold apartments in new buildings, and in August – 634 transactions. So this year, decreasing the price per square meter, the number of transactions has grown each month” – gives the example statistics analyst SV Development Sergey Stepenko. He and his colleagues believe that it is unlikely before the end of the year, a situation will arise that will knock

actual customer demand.

INCREASINGLY CHEAPER LUXURY. Consultants note: on demand all the blanket dragged on the segment. According to various sources, its share in sales – 69-79% in average annual cut. The rest is shared between the business elite and Deluxe , with the margin of the first segment. While most actively became cheaper three-and four-room apartments and more. “Demand is the lowest, even despite the falling prices. Service this housing will cost a pretty penny, that large families prefer to live in kopeck piece in the hope that the situation will change. According to this same philosophy back in fashion just a little odnushki instead of smart apartments,” says the broker in the sales of primary Daniil Makarenko.

The assignment is trying to compete with the usual sales

ASSIGNMENT. Another interesting trend on the primary market – the growth of the proposals on the assignment (in fact, the so-called sale of an apartment in an unfinished house). According to estimates of realtors, such proposals have become more about one third.

“Those who bought housing at the stage of excavation with the purpose of earning, now I try “Amalecites” to gain more money – they are nervous that the price of meter is melting. Of course, among them there are those who buy for themselves, but future plans have changed, and this is the most realistic way to get the money back with profit, – explains Dmitry realtor berestovoy. – I met recently, even the announcement of the assignment in troubled homes, where it is alleged there has been progress in the completion/communication”.

Give installments and mortgage – afraid

Installments from the Builder is a lifesaver for many buyers. It on different terms and conditions provided by many developers. Completely interest free, however, ready to give a few market operators, and in the process of clarification often emerges the need for any additional costs that still result in a price higher than the original. And the cost of meters in the installment is not fixed, so that the finished apartment can be more expensive. Terms of payment too is small: give installment only until the date of the house.

“If the crisis were real estate developers who have agreed on the installment plan, already under a certain rate, and conducted a long-term relationship with the investor and now these are hard to find. They are not profitable after passing the house and transition to new facility construction to collect bit by bit debts not bearing the profit”, – says Sergey Stepenko.

SEE ALSO

- Ukrainians will offer housing for lease with option to purchase

Another option home buying – mortgage. But she’s even worse: banks are reluctant to borrow large sums of Ukrainians. And the Ukrainians on the “draconian” conditions of banks (rates at 30% per annum) to take it do not hurry.

“There is a possibility to get a loan from those who have proven solvency, and borrowing from the Bank a small fraction of the cost of housing,” – explain in banks.

On the issues of reconstruction of housing loans shrug: “As international practice shows, mortgage and quicken loans when interest rates are 6-8%. But in Ukraine, the stakes were always higher, and the surge in lending is possible when they will drop at least 10%. If in 2017 inflation is, as expected, 6%, and in 2019 – 5%, then the offer of such products will appear at the end of next year. We have already paid back the loans, albeit not on a large scale. I think mortgage lending to the range we will have next year,” – said the Chairman of the Board of JSC “OTP Bank” Tamas HAK-Kovacs.

Sale. In installments are not rare, but the overpayment will still be. Photo: A. Boyko

Bring to mind someone else’s unfinished don’t want

According to state statistics, now in Ukraine there are more than 16 thousand objects of unfinished construction. Of these, about 11 thousand houses. Only in Kiev has about 700 unfinished projects. Suffered hundreds of thousands of investors, because other developers are not revived more than a dozen foreign “frost”, and lawsuits against negligent companies, as practice shows, can take years. In the Confederation of builders of Ukraine emphasize that to find someone willing to take on a difficult object, as the procedure is bureaucratic, labor – and time-consuming. But there are such people: for example, the Corporation “ukrbud” has already completed the construction of several unfinished for 5 years and engaged two more objects thrown by other developers, and one of them stood unfinished for more than 15 years! Completion of the last object had not yet begun – there is a registration of necessary permits.

To finish other people’s objects is a long process and very expensive

“About specific technical details it will be possible after obtaining all permits and approval of plan completion. But it is already clear that some designs will need to be replaced as they are worn and do not comply with modern trends of construction”, – explains a press-the Secretary “ukrbud” Gleb Shemavnev.

The company called and another problem in the completion of unfinished projects – the interests of the clients who invested in housing under the previous developer. Often, if the original plan of construction changes, people have to individually convince to give permission to change the layout or square footage. Often, just to look for all investors and confirm their property rights.

But with the last completed object case is unique: of the 136 apartments are already fully booked 121, affected investors are combined into a closed joint-stock company, and all information about them collected from the “shepherding” unfinished liquidator. You will have to pay only for those who have on the updated project will increase the square footage.

Forecast: the calm without the collapse of prices

Real estate agents say that while the final stupor market “save” a few factors. This “calm” dealware (though amid falling purchasing power) and a focus of some Ukrainians by their meters, where they have no pasture, is rented. The same situation in the current scenario, will continue until the end of the year.

“The market remains pent-up demand. People who, for example, a little short of money, and the mortgage/installment they do not want to communicate, prefer to decapite. While others expect sagging prices in order to buy more meters than you can now, – said the Director of the Metropolitan real estate Agency Valery Lomonosov. – So buy will be those who will deem that to wait any longer.”

EXPENSIVE TO MAINTAIN. Does not play in favor of the market and that, on the one hand, the construction cost is only more expensive and on the other to contain housing for some owners is becoming increasingly difficult because of soaring “communal”. Increase mentorplace, according to experts, “shielas” taxes (on real estate, luxury) and appreciation of life in General.

“To raise prices, developers are unable: purchasing power has deteriorated. But to correct the situation they can not, since the lower the cost per square meter is nowhere – explains the analyst of SV Development Sergey Stepenko. – Many sell away at cost, but the houses are empty to 50-60%. Therefore, according to my projections, will not collapse, and this sluggish situation as it is now, and will remain until the end of the year, if no political/economic force majeure will not happen. You may decorate the sales statistics for a festive event, but it is not a fact.”

Dates: all ripped

According to the IAP “Capital estate”, in August of 68 operators in the market of real estate offered for sale apartment 180 construction sites of Kiev. This number includes the remaining unsold meters in residential complexes, commissioned and accommodation in houses, the construction of which is ongoing. During the year appeared on the market 7 new “players” (in August 2016 proposed apartment 61 operator) and 32 of the construction (August 2016 in the analyst indicated 148 facilities construction). Basically this housing segment (32%) and “comfort” class (30%).

Most actively built up Holosiivskyi district of the capital (18% of the total capital of housing), Solomenskiy and Darnitskiy districts (14%), Shevchenko and caves (13% and 12%, respectively). Less housing is being built in the Dnieper area (8% of the new building), svyatoshynskyi (7%), Podolsky (6%), Obolon (5%) and Desnyanskiy (3%).

Until the end of September, according to market experts, the start of sales is expected to have a minimum of five complexes, and about ten sales “from the trenches” is expected until the end of the year. In this case, before the end of the year will put into operation only a few YC: basically, all developers have detained rows back.

Build. On the outskirts and in the suburbs with good infrastructure. Photo: A. Yaremchuk