Today Ukraine must start to pay debts to the International monetary Fund, which recently announced new requirements for the allocation of the next tranche. Recall, despite the fact that land reform IMF officials were allowed to push for the end of the year, is still actual changes in the pension system, privatization and fight against corruption. “Today” has learned when and how are we going to give the IMF money, and how it will affect the hryvnia exchange rate.

PROGRAMS AND DEBTS. Current tranches Ukraine receives loan program that the Fund approved in March 2015. To 2019, the lender must transfer $17.5 billion, of which $8.8 billion we have already received. The last, fourth tranche of $1.3 billion, recall, is listed in Apriland it was an unprecedented event in the relations between Ukraine and the IMF — all previous years, the cooperation collapses after a maximum of three tranches. However, Ukraine lags behind the official schedule is due to missed bills, the next tranche of $1.9 billion, which was expected on 15 August, the IMF was postponed to a later date — at least until the end of this year.

SEE ALSO

- How to change the life of Ukrainians in August: call in the army, dollar and rent a new way

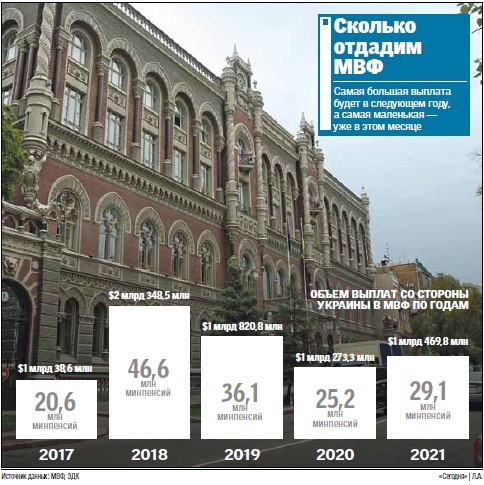

According to economic analyst ForexClub Andrew Shevchishin previous two years Ukraine did not make debt payments — acted a grace period. But today, the national Bank must transfer to the Fund a little more than $85 million Next payment is scheduled for August 15 and should reach as much as $356 million And by the end of the year our country should give the Fund a little more than a billion dollars. However, most will have to pay the money next year, and the worst would be February, may, August and November. In General Ukraine until 2021 will give the Fund $7.9 billion — about $192 from each Ukrainian (see infographic).

THERE IS NO ESCAPE. The Executive Director of the Economic discussion club Oleg Pendzin notes that the option not to pay the debt to the IMF, our country does not.

“Debt to international financial institutions is not restructured. That is not to repay these debts we can’t. Another thing that you need to consider the credit rating of the country, and with it the profitability of new lending, almost entirely dependent on cooperation with similar organizations. Roughly speaking, if Ukraine refuses to pay the bills, it may soon lead to complete international isolation and the closure of the country to foreign direct investment“, — said the expert.

The Pendzin notes that the money to repay already existing loans will go mainly from new borrowings. “To understand the depth of the problem: this year, the amount of servicing external debt at 32% exceeds the sum of the basic debt payments to the IMF, and external debt service this year will amount to more than 54% (over 35 billion) from the budget deficit. But the situation would definitely be easier with the effective impact on the economy. For example, if confiscated funds in criminal offences was directed at reducing the size of the debt,” — concludes the expert.

The course after the payment: the dollar will rise

According to the economist Ivan Nikitchenko, the start of payments on IMF loans in the second half will be another factor of pressure on the national currency: “the Schedule of repayment of loans are very well superimposed on the forecast of the government at the exchange rate of the hryvnia to the end of 2017 — 28-29 UAH per dollar. So, in my opinion, by the end of the summer the trend of strengthening of the exchange rate in Ukraine will stop and he will return to the level of 27-27,5 UAHas it was in the beginning of the year. In subsequent years, the schedule becomes even harder for the hryvnia, and to compensate for this outflow of currency can either new tranches of the IMF or a more active growth of Ukrainian exports”.

However, Shevchishin recalls that repayment of loans will be at the expense of foreign exchange reserves, which recently rose to nearly $18 billion. “Accordingly, even after paying heavy pressure on reserves will not, and this fact will not affect the hryvnia exchange rate,” he says, adding that, most likely, the hryvnia will impact inflation and the beginning of a new business season.