Last year the government announced that in the framework of the pension reform in Ukraine will start a second level system, and the Ukrainians will be able to accumulate a portion of the single social contribution on personal accounts. However, in 2017, a cumulative level and not work. In the Memorandum with IMF, the authorities have pledged not to run a cumulative level until, until will not be liquidated, the deficit of the Pension Fund (PF). The website “Today” figured out why Ukraine still has not launched a cumulative level and whether the Ukrainians themselves to collect on a “deserved rest”.

What is a funded system, and how she had to work

“We want elements of a funded system, was launched in early 2017,” said last year’s Vice-Prime Minister Pavlo Rozenko. In may, Prime Minister Volodymyr Groysman presented a project of reform, but the question of mandatory funded system is not coming. The funded pension will be introduced only for the miners, and that in order to release the Pension Fund from the “darling of miners ‘pensions” and delegate to these costs to employers. Rate social contribution will increase from 22 to 37%. This is the first grace the list, which includes miners, some doctors, employees of chemical industry, subway, etc. From January 2019, the additional contributions for employees of these specialties under the age of 35 will not accumulate in the Pension Fund and an individual account.

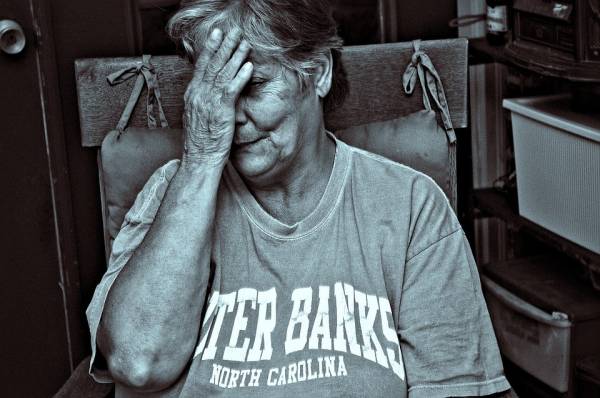

Photo: Pixabay

Levels of the pension system:

- Solidary system (ongoing). These funds are awarded pensions

- Funded system (plan to launch). Part of the contribution will be accumulated in individual pension account

- Cumulative voluntary system (private pension funds)

In one of the bills on pension reform savings level plan to introduce this year. If the document is adopted, all the Ukrainians under the age of 35 would have in addition to the unified social contribution (which is 22% of salary) to pay this year 2%, and 2022 – 7 percent. Ukrainians older than 35 but younger than 55 could voluntarily join the funded system and pay contributions. Current pensioners innovations wouldn’t touch.

Cumulative level should work in parallel with solidarity. After retirement Ukrainians will be able to receive two payments from the two funds. This will increase the overall size of their pension. Funds in the savings account shall be invested in the economy, and any accrued interest added to savings. This would compensate for inflation.

“My argument in favor of a funded system is very simple. If you are running a solidarity system, to ensure the replacement rate of 0.6 (i.e. the pension will be at 60% of the minimum wage. – Ed.) running generation need to deduct 32-36% of salary. And in order to provide the same replacement rate under the funded system, you have to pay 0,12-0,17% of salary. We propose to leave the joint system and to introduce a funded while on a small level,” – said the expert in the sphere of pension provision Galina Tretyakov.

Why cumulative level is not launched and when it can earn

As explained in the Ministry of social policy, under current legislation, to start a savings Fund should only after liquidation of the Pension Fund deficit. Prime Minister Vladimir Groisman suggests that to eliminate the deficit only in 2024-m. Then can fully earn a cumulative level. This year the budget provides for a deficit of $ 141 billion.

According to a senior researcher of the Institute of demography and social studies Lydia Tkachenko, if Ukraine has launched a state of the compulsory accumulative level, the risks would have to take the state. And given the fact that in Ukraine there is no stock market and investment targets, which would not only compensate for inflation but also to increase the funds collected, not so much risks in this area quite a lot. “The problem of the second level, why does the IMF not recommend him to enter that the state did not take on additional responsibilities,” says Tkachenko.

“The problem of the second level, why does the IMF not recommend him to enter that the state did not take on additional responsibilities,” says Tkachenko.

Photo: Pixabay

The Minister sotspolitiki Andrey Reva reminded that in 2015 the inflation rate was above 40%. “You can call structure in Ukraine, which 20 years is able to give at least 2% above the rate of inflation today? Nowhere to put it. Even if the money we hypothetically found, but to invest in the country nowhere. Let’s move abroad will saturate its economy”, – says Andrey Reva.

In PF they say: since the adoption of the decision on start of the funded pillar and to implement this solution should pass at least a year and a half. “We in law second level registered for a long time, but there are no dates. The bills were dates, but the bills remained bills. There were allegations that this year’s cumulative level starts, no one will remember. I’m not saying that there should be preparatory work, established infrastructure, should be generated a cumulative level,” explains Lydia Tkachenko.

What to do until the cumulative level not earned

In addition to pension from the state, every Ukrainian has the opportunity to participate in a private pension Fund. In many EU countries and the US, these funds have existed for many years, in Ukraine, private pension funds started to operate only in 2003. And although, according to the author of the book “Towards the future. Guide to non-state pension funds,” Alexander Weaver, neither Fund has not been declared bankrupt, and if it were recognized as such, the accumulation of Ukrainians would be moved to another Fund of the trust to private pension funds is still low.

One of the largest Ukrainian banks offers investors to set aside each month 200 hryvnia “old age”. If you save for 30 years, by 2047-th can be obtained every month, 113 thousand hryvnias (monthly NPF promises to earn 20% of the Deposit amount). Don’t know what I can buy with the money in 30 years.

According to the law in Ukrainian private funds may open an account citizens of other countries, but the Ukrainians to collect on a pension in foreign funds difficult: at the moment there are restrictions under which open foreign currency accounts abroad and Deposit them in your possession.

Photo: Pixabay

The main problem of private pension funds in Ukraine is absence of the stock market and the difficult economic situation. So savings are not “burned” funds needed each month to earn the amount, which will not only cover inflation, but also multiply money. As told in an interview with “Today,” the Minister sotspolitiki Andrey Reva, no one can predict what will happen to these funds in 10 or 20 years. “Today, to convince me that we need to invest in our financial institutions very difficult,” – says Andrey Reva.

Another way to “gather up” for retirement is to open an escrow account and Fund it each paycheck. Now the average Deposit rate is 16-18%. This is enough to not only offset inflation, but also to increase savings. If a private Bank closes guarantee Fund returns part of the Deposit 200 thousand UAH. Therefore, experts suggest either to open several deposits in different banks worth up to 200 thousand, or invest money, for example, in the state “Oschadbank.” Under current law, if “Oshchad” closed, depositors are entitled to compensation deposits in full due to the budget of the country.

However, as stated in the Ministry of Finance and the NBU, in future years “savings” can pay for privatization, the same plans of the officials and “PrivatBank”. After the privatization to guarantee the deposits of customers of these banks in full, the state will not.