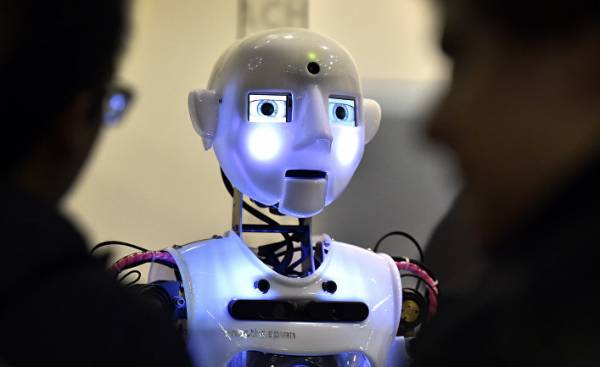

I usually agree with bill gates on state policy issues and admire his particular underlining the combined forces of markets and technology. But, I think he’s really lost his way in a recent interview, when she offered, without apparent irony, to tax the robots to mitigate the process of mass dismissal of workers and reduce the inequalities.

Co-founder of Microsoft right about the seriousness of the problem and the need to adopt appropriate measures, but he is deeply mistaken in regard to the proposed solutions, and does it in a way that gives the sharpness issues with the current public debate. First, I don’t see any logic in trying to introduce robots as the destroyers of jobs. What can you say about the terminals, issuing the boarding passes for the plane? What can you say about the word processing software that accelerates the process of drafting? About mobile banking technology? About Autonomous cars? About vaccines that prevent illness and thus reduce the number of jobs in medicine? There are a large number of innovations that allow you to produce more goods or goods of better quality while using a smaller quantity of labour expended. Why quibble over the robots?

Maybe Mr. gates thinks that any man, not to mention the U.S. Congress, the administration trump or Commission of like himself technocrats who can distinguish between efforts aimed at rationalization of labor, and efforts aimed at the intensification of work? It is difficult to understand why the reduction of the pie instead of its maximum possible increase and subsequent redistribution is the right direction.

Even if experts could hold such a distinction, the ability of the IRS to administer such things is questionable. Second, a significant portion of innovative activity, even in the field of robotics, involves the production of higher quality goods and services, not just increase production with the same attachments. For example, Autonomous vehicles are likely to be more secure than those managed by men. Robotics is already helping surgeons to conduct some operations and do it better than using only their own capabilities.

The system of online reservation is faster and more convenient than the services of travel agents. Moreover, because of rivalry and competition innovators receive only a small profit from their innovations. This implies that there is reason for subsidies, and the taxation of capital, which carry out innovation. Thirdly — and perhaps this is the most fundamental part, the question arises — why introduce taxes in a way that minimizes the size of the pie, instead of care that larger pie was well proportioned?

Imagine that 50 people can produce robots that will do the work of 100 people. A sufficiently high tax on robots will allow them to produce. Wouldn’t it be easier for companies to instead more product and install the suitable taxes and transfers to protect the replaced workers? It is difficult to understand why the reduction of the pie, instead of its maximum possible increase and the subsequent realignment is the right way forward.

This last argument has long been standard in the theory of international trade. In fact, usually indicate that to open the country to international trade means just to provide her with access to technology for transformation of one commodity into another. And since, according to this argument, nobody will take such technical change is bad and trade is not bad, that’s kind of why protectionism is bad. Proposed by Mr. gates a tax on robots risks, in fact, prove to be protectionist and against progress. None of this will lead to minimize the problem of job cuts and growing inequality (although the main paradox is that we seem to see the rapid and unprecedented destruction of jobs with machinery, but note the extremely low labour productivity growth). Rather, it can be assumed that the creation of obstacles to progress is a bad strategy aimed at helping workers who find themselves in a less advantageous position.

In addition to the difficulty of identifying and associated costs, there is another problem, and it consists in the fact that in the open world taxes on technology is likely to lead to the relocation of production abroad, not to create jobs at home. There is a large amount more correct approaches. However, governments need to deal with the problems of structural unemployment. Most likely, they will need to select for themselves a clear role in ensuring full employment than that which currently exists in the United States. Among other things, this will mean conducting deep reforms in education and training. You will also need to address the issues targeted subsidies to wages for those groups where there are particularly difficult employment situation.

In addition, it will need significant investment in infrastructure and, possibly, direct the state programs in the field of employment. Will be a serious debate, which, I believe, will determine much of the politics of the industrial world for next few decades. With confidence we can say only a small number of things. But it is better to move forward, not backward. This means to make America even greater, and again not great. And that means the use of technological progress, not rejection of it.