Money like that we puzzled. First over the way to earn them in sufficient quantity, and then how to spend it wisely and to ourselves to provide, and something for a “rainy day” set aside. And here comes another interesting topic: where to invest it to not only not lose from inflation, but also multiply? Where better to “hide” their money for the coming year, we were told the economist International centre for policy studies, Alexander acorn, the Deputy Chairman of the Board “Bank Credit Dnepr” Andrey Moyseenko, member of Ukrainian society of financial analysts Vitaly Shapran and senior analyst at GK FOREX CLUB Andrey Shevchishin.

CURRENCY EXCHANGE ON THE WAY TO STABILIZATION

On the one hand, there is some devaluation of the hryvnia compared to the previous year (non-cash dollar grew by 8.7% (from 24.15 to 26.25), cash — by 8.8% (from 25.40 to 27,63). On the other hand, this decrease does not compare with the joy that the national currency has experienced a year earlier. “We see that the hryvnia gradually began to emerge from the influence of the psychological factors and the course is increasingly dependent on economic trends, — says Andrey Moyseenko. Today the foreign exchange market in Ukraine has become more predictable. Even autumn-induced destabilization of the political situation in the country or market volatility due to the nationalization of “PrivatBank” was quite short.”

According to Moyseenko, the current relative stability of the exchange rate justified by the growth of the Ukrainian agricultural exports to the EU countries — relatively high volumes entering the markets of foreign exchange earnings. “And the national Bank have enough instruments to deter any critical fluctuations”, — says Andrey Moyseenko.

Store cash this year turned out to be a losing strategy.

However, as we can guess, since the hryvnia is cheaper, it is not so good, including exports. “The main reason of weakening of a course by the continued decline of Ukrainian exports, with the stabilization of imports, — says Andrey Shevchishin. Under pressure during the year were the prices of cereals, which did not allow to realize the full potential of high harvest.”

In addition, it is important to understand that this is not so much the hryvnia became cheaper, as the dollar rose in price relative to other currencies. As pointed out by Andrey Shevchishin, the world markets are marked by the growth of the dollar index to the highest since 2003 levels after winning Donald trump in the presidential election in the United States with an active program to stimulate the American economy and tightening of monetary policy of the fed that the rise of the dollar. In any case, the strategy of saving “dollars in a pillowcase” this year has been ineffective: the growth rate of “green” is not even caught up with inflation (12%).

GOLD HOLDS INTRIGUE

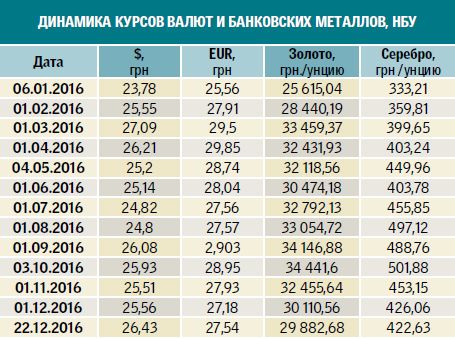

“Dynamic pricing for precious metals in General and gold in particular in Ukraine depends on world market prices and internal exchange rates”, — says Andrey Moyseenko. On world markets the price of gold during the year decreased by 5.9% — from $1066,3 to $1130,0 per Troy ounce. But we in the national currency due to its devaluation, the yellow metal has risen in price: gold rate of the NBU grew by 16.9% — from UAH 25 to 29 440,7 738,6 UAH per Troy ounce.

“The main reason for the reduction in price of gold was the monetary tightening policy of the US and a stronger dollar, and a reduction in demand for gold from the major consumers

th — China and India”, — says Andrey Shevchishin. However, opinions about the investment prospects of gold differ. “Now we can look at its potential, — says Andrey Moyseenko. During the political turmoil of the investors, wishing to avoid risks, prefer to invest in so-called “safe haven”, which are precious metals. Recently happened a lot of political events, putting pressure on world markets: Brexit, the U.S. presidential election, frequent terrorist attacks and so on. After the elections in America and stabilization in the global markets, gold fell slightly in price. But we expect to grow in the near future: the main Central banks of the world (USA, EU, Japan) are on the path of weakening currencies, buying including low-quality assets and thus throwing on the market a significant amount of money. All seek to escape from the risk of deflation, filling the markets with money”.

Another look at Alexander Acorn: “the Policy, which is expected from trump, should lead to higher economic growth and higher inflation. Inflation would stimulate the growth of gold prices. But economic growth means that there will be projects that have a greater return than physical gold, and this leads to reduced prices”.

THE STOCK MARKET IS ALMOST THERE

The brief description of the situation in the stock market gave Vitaly Shapran: “the Stock market just yet. Don’t even write about it.” A few softer spoken, Alexander acorn: “It is, of course, is available. But seriously talking about it for no reason. Given that even those enterprises which were considered in our sites “blue chips”, have had or have a serious problem.”

The point, however, is not only a difficult economic situation and the current problems of specific companies. “Even today we have quite a lot of big business, which might be interested to get the money by selling part of the shares, — says acorn. But business is not ready to share control over the enterprise, even if we are talking about a minority package”. The reason is that we have no guaranteed protection against the various schemes of raider attacks, so to give even a portion of the shares in the hands of others is risky. On the other hand, we are not protected adequately and the interests of the small investor: “If a minority shareholder buys shares, he expects to receive dividends. And we often owners decide not to pay dividends, and invest in the projects”, — says Alexander acorn.

However, those who successfully invested in the first investment funds (PIF), this year’s loser — the maximum the growth of unit value in the first 11 months amounted to more than 33%. On the other hand, enough funds have demonstrated a yield below the rate of inflation. And there are those who worked a loss of up to minus 20%.

Risk. In the stock market you can earn and lose.

THE BEST: DEPOSIT

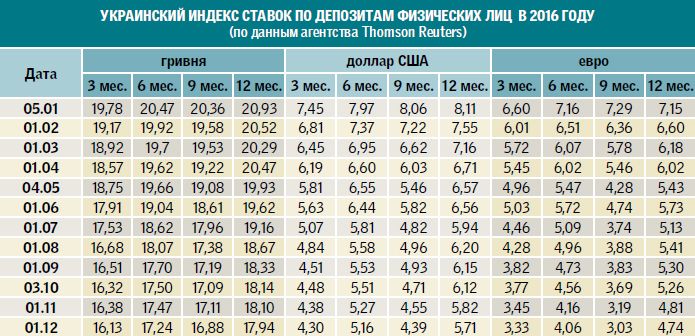

In the past year the Bank remained the most profitable of any reliable types of investment. Most reliable best though and took the path to the gradual curbing of their generosity. “Rates on deposits in hryvnia and foreign currency continued to decline, — says Andrey Shevchishin. — Interest rates on UAH annual Deposit decreased from 21.28% (average in December 2015) to 17.72%, while the dollar fell from 8.27% to 5.7%”.

REASONS. The experts have several explanations for this trend. “The General decrease in inflation and expected inflation, — says Alexander acorn. At the end of last year, us annual inflation was 43%, and at the end of that will 12% is a significant difference”. With such low inflation even lower Deposit rates serve as a sufficient reason to carry the money to the Bank. Hence, another reason, which acorn says: “If we look at the end of last year, then a continued outflow of deposits from the banking system. Naturally, the outflow of banks were interested in keeping the deposits, they had to raise rates. If we look at the situation this year, the volume of foreign currency deposits started to increase by the end of the year, and the hryvnia even earlier. That is, people carried money back to the banks”.

As reported by us in one of the banks, the Deposit portfolio of the population in it this year increased by 12%: “This contributed to the increase of trust of Ukrainians to the financial system, and, accordingly, a significant increase of banks’ Deposit base. After the crisis financial institutions have enough liquidity to walk away from attract resources for an inflated price,” confirms Andrey Moyseenko.

“In addition, the dynamics of Deposit interest rates influenced the decrease in the discount rate controller, which we witnessed during this year: in 2016, she declined 6 times, and is now at 14%,” says Andriy Moyseenko.

But there are less pleasant to the ear of reason: “the major decline in Deposit rates is the low lending because of the weakness of the economy and the low reliability of borrowers”, — says Andrey Shevchishin. If you collect all together, we get the following: banks have collected enough money for the deposits to be enough for today’s sluggish lending, to expand that they are still not too motivated. And if you still need money, it is cheaper to borrow from the NBU, than pay to depositors.

The higher rate of Deposit can be a symptom of the problems of the Bank.

STATISTICS. In addition, lower average rates contributed to the withdrawal from the market of several banks. In most cases a “burst” of the companies was characterized by a high generosity of Deposit rates. But if we from the aggregate data, we remove the largest value, then the average becomes lower. “Yes, there is such an effect, — agrees Alexander acorn. — Moreover, the higher rate of Deposit than the market in General, is one of the signs that the Bank has problems. Most likely, he doesn’t have enough money, so he immediately tries to obtain additional funds due to the higher percentage”.

TRUST. By the way, it would seem, held a hearty “bankopad” would permanently deter the Ukrainians from investments in deposits, but it turned out otherwise. “And that, in fact, the small investor has lost in the banking crisis? — rhetorically asks Vitaly Shapran. The most he could lose on the devaluation for those 3-4 months, which on average took place, while people were getting their money from the Deposit guarantee Fund. It’s all minor losses compared to the body savings. And in the case of “PrivatBank”, I believe that investors not only lost, but actually gained: they put the money at commercial rates, and got a state Bank and a guarantee of 100% of their funds.” Paradoxically, the severe crisis of the banking system showed that it in General can be trusted.

WHERE TO INVEST

Nothing sensationally new to offer for investment the following year the experts we are not ready. “Deposits traditionally remain the most rapid and simple way to get additional income”, — says Andrey Moyseenko. I agree with this and acorn: “If we talk about the combination of criteria such as yield and reliability, the main object of investment is a Bank Deposit”.

RATES. “When peaceful socio-economic situation rates for all types of deposits will continue a gradual decline (around 1.5—2%), — predicts Andrew Moyseyenko. — This will allow the banks to actively increase lending to the population and the economy, making it more accessible.” Andrew Shevchishin also foresees a slight decrease in average Deposit rates to 2017, including by reducing interest rates at nationalized “PrivatBank” to the levels of state-owned banks. On the other hand, Vitaly Shapran believes that if a national Bank in the first quarter will not lower the discount rate, Deposit rates remain unchanged or even slightly older. “Let me remind you that the national Bank several times already this year reduced interest rates. It’s too soon and often, — said Vitaly Shapran. — A market still need to digest “PrivatBank”.

CURRENCY. To optimally allocate their deposits for currency baskets, it is necessary to consider possible next year devaluation of the hryvnia against major currencies. And it seems that the national currency has to weaken. “We have a fairly important export commodities remain ferrous metals, providing about a quarter of the export income, — says Alexander acorn. — And the following year, while projected lower average prices, which means less inflow of currency into the country”

.

Another factor specifies Vitaly Shapran: it is expected that in the spring of 2017 the key interest rate the fed is going to increase almost two times. “If that happens, it’s not a good situation for emerging markets such as India, Pakistan, Brazil, Russia and Ukraine including. It will hit business activity, the popularity of national currencies”. “If the fed rate rises, this means that it becomes more profitable to invest in the American economy, explains the mechanism of this trouble, Alexander acorn. But the weakening of the hryvnia will not be too significant. “In the baseline scenario tend to rate at the level of 27-28,5 UAH per dollar. In the absence of cooperation with the IMF and socio-political instability in the country the rate may be in the range of 28-30,5 UAH and above, depending on the policy of the NBU. The Euro will be in the same borders as the dollar”, — said Andrey Shevchishin. In these circumstances, Alexander acorn believes that the optimal allocation of their deposits between the dollar and hryvnia in the proportion 50% to 50%. And Vitaly Shapran recommends that the hryvnia part to take no more than 20%.

TIME. “Deposits for 3-5 years — not the story today. Ukrainians mostly choose to embed means the period of 6-12 months”, — says Andrey Moyseenko. “In the short term (quarter or six months) Deposit in UAH remains the most acceptable from the point of view of profitability and risk. While waiting for lower rates, accommodation is better to exercise early in the year, says Andrew Shevchishin. — In the longer term, waiting for stabilization of the housing market, you can invest in real estate. Also in the horizon of 3-5 years, the attraction retains the gold acts as a hedge against inflation”.