This year the Cabinet of Ministers has announced a major pension reform in Ukraine. The reform provided a Memorandum on cooperation with the International monetary Fund (IMF), which is currently still in negotiation. Government officials together with international experts formed a working group to develop reforms. The main goal is to reduce the deficit of the Pension Fund (PF), and to increase pension payments. The website “Today” figured out how future innovations can change the lives of Ukrainians.

The retirement age increase?

No, as stated by the Prime Minister Volodymyr Groysman, to raise the retirement age, the Ukrainian government is not going to. Although, according to the Minister sotspolitiki Andrey Reva, such as IMF insists.

At the same time, most experts agree that sooner or later this step will have to go. The arithmetic is simple: now 10 employees comprise 11 pensioners, if the situation does not change after a few years, 10 Ukrainians their taxes will provide for 15 retirees. The population is aging not only in Ukraine but throughout Europe.

By increasing every year the retirement age by six months, says a senior researcher of the Institute of demography and social studies Lydia Tkachenko, the number of pensioners in Ukraine will be reduced by one million, this will increase the number of employees.

They say that the state did not have enough money for retirement. Ukrainians in General can remain without pensions?

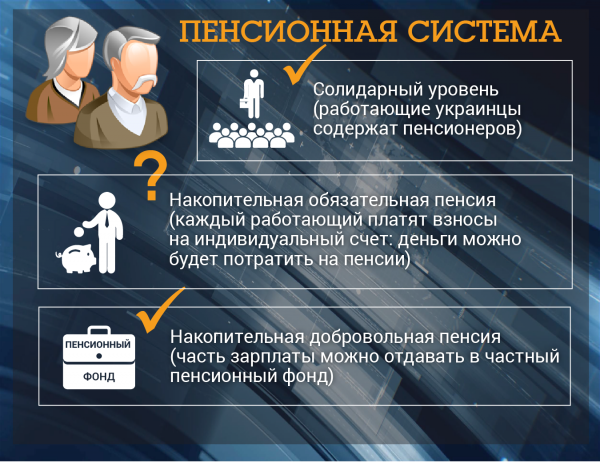

Money is really sorely lacking. Now we have a solidarity system, in other words, working Ukrainians contain citizens “retirement”. System deficiency – more than 140 billion hryvnia. This is the “hole” that arose after the distribution of all collected pension tax (the so-called social contributions) of pensioners.

The deficit is compensated from the state budget. The growth of the “hole” predicted at the end of 2015. Then the government decided instead of 37% to collect from the salaries of Ukrainians in retirement of just 22%. The deficit sharply (nearly 40 billion) raised in 2016.

But pensions will be paid in any case, claim in the Pension Fund. However, in conditions of major shortage, to provide Ukrainians with decent pensions will fail.

After the reform, pensions will grow?

Under current legislation, pensions increase by the rate of inflation in may and December of each year. This year inflation is set at the level of 8.1 percent, and pensions will grow by 10.1%. Certain categories of pensioners promise to “modernize” pension of 300 hryvnia.

Now the main task of the reform to reduce the deficit of the solidarity system, only then will be able to significantly increase payouts. The government promised that the reform will make “the pension system fair.” However, based on the approved budget for this year, fundamentally the amount of the pension for Ukrainians in 2017 will not change.

How will reduce the deficit, if the retirement age does not increase?

There are several possible solutions that have been announce in the Cabinet. For example, to prohibit pensioners to work (either work or receive a pension). Also Miniprofile published a proposal to allow to buy the missing experience (for 704 UAH per month). A few hours later the publication from the Ministry website was removed.

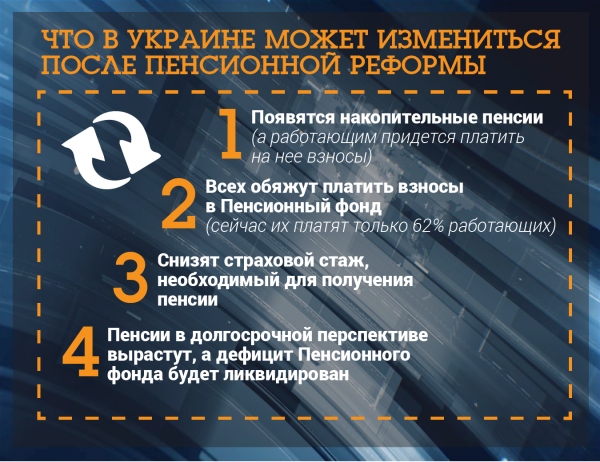

In addition, of the 16 million employed Ukrainians Pension Fund contributions are paid only 10 million people. The others (farmers, service workers, and so on) have the right not to pay. In an interview with the “Today” Deputy Chairman PF Mykola Shambir noted that Ukraine may be obliged to pay contributions to a pension all workers.

According to Andriy Reva, to completely eliminate the deficit of the PF is possible by 2024.

When impose a cumulative level?

Currently funded level of the system still remains in question. PF said that in this year to run it definitely will not succeed. And Minipalette remind: under the law the cumulative level work after having eliminated the deficit of the solidarity system.

If you introduce a cumulative level, would have to pay two taxes on a pension?

Yes, you can recharge a cumulative level will be a separate tax. That is, as now, 22% of salary will have to pay to the joint system, several cent, in cumulative. In one of the bills on pension reform had assumed that all the Ukrainians under the age of 35 have to pay extra 2% of salary to personal pension accounts in 2017, and 2022 – 7 percent.

Money should be accumulated until retirement age. That is, to the age of 60, if you run a cumulative level, the Ukrainians will be able to receive two pensions. Those who have already retired, the pension level will not be affected.

And what is the guarantee that the pension Fund will not go bankrupt and the savings will not “burn”?

Says Andriy Reva, there are no such guarantees. Experts explain that the cumulative level of “right” works in the advanced economies, where the inflation rate may fluctuate within a few percent. We have, over the last three years rates, according to the NBU, increased by 80%. That is to ensure that the savings are not “ate” inflation, with 2014 cumulative Fund was supposed to increase savings by 1.8 times. This, I’m sure Reva, is almost impossible.

What should I do?

To collect retirement needs from an early age, I’m sure the founder of the training center “Cashflow Ukraine” Alexey Polovinkin. Ukrainians can not invest money in private pension funds abroad, where this system has worked for decades. But you can collect retirement in the Ukrainian non-state pension Fund.

Read more about where to invest money, you can read here. Experts advise to buy the currency of different countries, to open deposits in banks amount to UAH 200 thousand (just as, in the case of closure of the Bank will return the Deposit guarantee Fund) and, if possible, to buy real estate.