In Ukraine in October this year to cancel the “taxes” for retirement and “modernize” payment. If the Parliament will support the draft pension reform, current retirees will get richer and the formula for calculating payments will change. In addition, in January next year, will change the requirements for retirement pension. The website “Today” has collected the main innovations that will affect all Ukrainians after the pension reform.

Pensions will asurement

In October of this year to 5.6 million Ukrainians will recalculate pensions. More than 1,000 hryvnia, rich 1.1 million pensioners. Increase from 900 to 1000 hryvnia unable to 487 thousand pensioners, from 700 to 800 UAH 460 thousand. The rest (and more than 3.5 million Ukrainians) the pension will rise from 50 to 700 hryvnia.

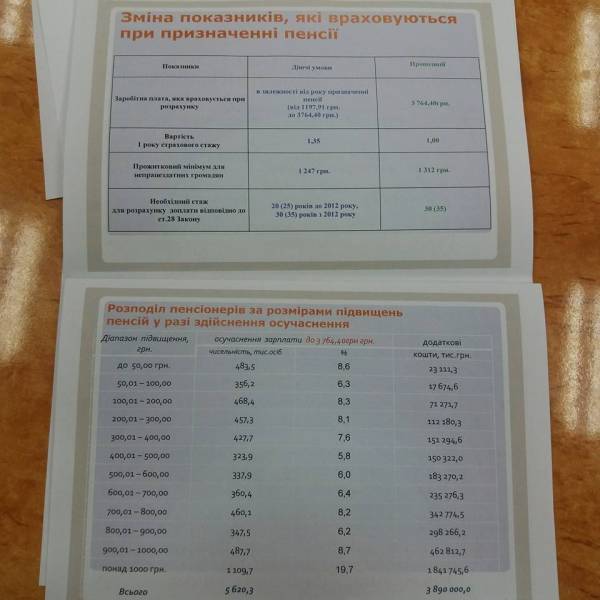

The pension depends on the average salary in the country for three years, length of service and their salary. Now some pensioners receive payments based on the average wage in hryvnia 1197,9, this figure is projected to “modernize” up to 3764 UAH.

For example, the pension for the Ukrainian, who has worked for 35 years and received an average salary, can be calculated as: 1197,91 * 1 * 0,47 = 562,9 hryvnia. Given that the pension age in Ukraine can not be lower than 1312 hryvnia, the hryvnia 749,1 pay from the Pension Fund. After “modernizing” the same pension will be recalculated according to the formula: P = 3764 * 1* 0,35 = 1317 UAH. However, if wages, for example, was twice the national average, is now retired (with 35 years of experience) 1312 receives the hryvnia, and after the “modernization” will be to 2634 hryvnia.

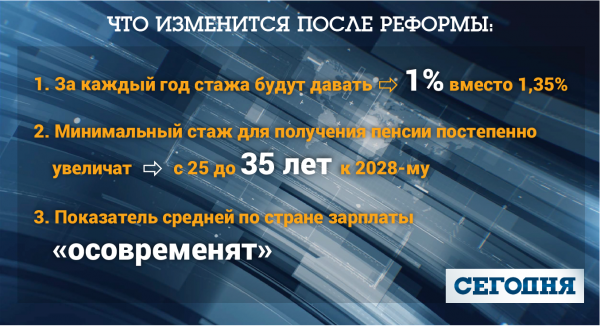

The formula for calculating pensions will change, and the necessary experience will improve

At the moment each year when calculating the pension multiplied by a factor of 1.35. The government plans reform to reduce this ratio to 1. Experts in the field of pension provision explain: as a result, the size of pensions for those who have not yet retired, reduced by at least 35%. In addition, changes and requirements for obtaining a minimum pension. In the following year to receive the minimum pension you need to have at least 25 years of service. Each year of the required experience will increase by 12 months.

If by 2028 to accumulate only 30 years of experience, will either have to buy the missing experience, or to work to 63 years. In the presentation of the Cabinet says that in 2028 at age 60 to retire will be able to reach only about half of Ukrainians of retirement age. 40% will go on a holiday in 63 years, 5% in 65 years. Those who to rework not want to buy experience – one year is 16 896 USD. You can buy up to two years of experience. Prime Minister Vladimir Groisman said that talking about raising the retirement age reform is not. But, in fact, half of Ukrainians retirement age still increased.

Those who do not have the right to a retirement pension due to the lack of experience is social assistance in the amount of 30% of the subsistence minimum for the disabled. At this point it is from 400 hryvnia per month. “Social pension” in Ukraine receive less than 100 thousand Ukrainians. After tightening the requirements for obtaining old-age pensions, the number of “social seniors”, experts suggest, may rise several times.

Cumulative level can enter in 2024-m

In one of the bills on pension reform savings level plan to introduce this year. If the document is adopted, all the Ukrainians under the age of 35 would have in addition to the unified social contribution (which is 22% of salary) to pay this year 2%, and 2022 – 7 percent. Ukrainians older than 35 but younger than 55 could voluntarily join the funded system and pay contributions. Current pensioners innovations wouldn’t touch.

Cumulative level should work in parallel with solidarity. After retirement Ukrainians will be able to receive two payments from the two funds. This will increase the overall size of their pension. Funds in the savings account shall be invested in the economy, and any accrued interest added to savings. This would compensate for inflation.

As explained in the Ministry of social policy, under current legislation, to start a savings Fund should only after liquidation of the Pension Fund deficit. Prime Minister Vladimir Groisman implies that lto equivaut deficit only in 2024-m. Then can fully earn a cumulative level. This year the budget provides for a deficit of $ 141 billion.

According to a senior researcher of the Institute of demography and social studies Lydia Tkachenko, if Ukraine has launched a state of the compulsory accumulative level, the risks would have to take the state. And given the fact that in Ukraine there is no stock market and investment targets, which would not only compensate for inflation but also to increase the funds collected, not so much risks in this area quite a lot.

A tax for working pensioners to 15% will cancel

Now about 500 thousand working pensioners receive only 85% of the pension. The government plans to abolish the tax and to pay working Ukrainians “retirement” with full pension.

If the “tax” really going to cancel, half a million Ukrainians receive a pension in October about 17% higher. For example, if at the moment employed Ukrainians receive a pension in 2000 hryvnia, on the first of October it will increase to 2352 UAH. The fact that under article 47 of the law “On state pension insurance”, working Ukrainians are only entitled to 85% of the earned pension. The rest is state. If after charging 15% of the working Ukrainian remains the pension less than UAH 1870 (150% of the subsistence minimum for the disabled), will be paid a full pension. The experts note, the retention of 15% of the pension is not tax, and partial payment.

“The taxation of pensions is not taken into account, a pensioner or not. If a person works and has a pension greater than 150% of the subsistence minimum for the disabled, he pays 85% of the pension. It’s not taxation, this is a partial payment,” explains Lydia Tkachenko.