The U.S. dollar index (the dollar against a basket of world currencies) at the end of February 2017 rose 1.6%. However, as analysts Forex club in Ukraine, support for the dollar has a high probability of a rate hike by the Federal reserve system (FRS) in mid-March, while the world’s Central banks are not willing to go to such tightening.

At the same time, the US government never launched the tax incentives (reducing tax burden by 75% and more) that kept fears of the imminent expansion of fiscal spending and acceleration of inflation in the country.

As you know, tomorrow, March 2, the national Bank of Ukraine (NBU) announced will remain unchanged if the discount rate in Ukraine. Note that from March 2015 the national Bank gradually reduced the discount rate from 30% to 14%

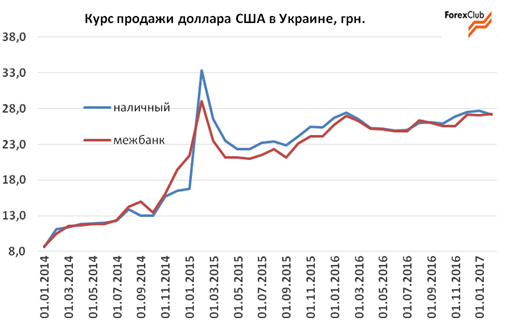

Selling rate of non-cash dollar in Ukraine in February increased by 0.4% to UAH 27,22, cash decreased by 2.1% to UAH of 27.15.

Experts call such reasons for the decline in demand for the dollar on the market:

- stabilization of foreign exchange inflows to the country;

- liberalization of the foreign exchange market to the banking sector by the NBU.

The average spread on cash transactions with the U.S. dollar in February has narrowed to 1.5% from 2.5% in January 2017, reflecting the stabilization of the market and the reduction in the share of the black market. As experts noted, the average difference between cash and non-cash rate dropped to 1.4% – the lowest since October of 2016.

FORECAST. According to analysts Forex club, the hryvnia on the cash market in March may be in the range 27-28,5 UAH per dollar. Experts say that in March and April, the hryvnia traditionally stronger.

The demand for currency is reduced in anticipation of the completion of the heating season and reducing the cost of critical energy imports. At the same time, the inflow of foreign currency increases against the background of growth of business activity; in addition, farmers plant their currency to Ukraine for the sowing campaign.

Support the hryvnia have also waiting for the financial assistance, primarily the IMF tranche in the amount of 1 billion US dollars.

In early March, the hryvnia may come under pressure in connection with the purchase of currency for dividends by non-residents. In addition, there are risks of weakening the hryvnia from the reduction in industrial activity mining and metallurgical sector amid the blockade of Donbassand, as a consequence, the reduction of foreign currency inflow into the country.

Long simple and “eating inventory”, shortage of raw materials in chiles anthracite coal, shall be filled either by imports or by a reduction in manufacturing activity. In the first case, the experts expect growth of demand for currency, in the second, the fall in the inflow of foreign currency in Ukraine. Given this trend, the NBU has already declared about possible exchange rate fluctuations and reducing foreign exchange inflows to $ 2 billion.

“To restrain fluctuations in the market, the NBU may, through the cash mechanisms of market and non-market in nature, but it is unlikely he will go on active intervention and allow the exchange rate to controlled otkorektirovat. The transition to non-market constraints is possible only if the situation gets out of control. At the same time, to maintain the competitiveness of Ukrainian exports, the regulator will restrain the strengthening of the hryvnia UAH 26,5 above. for a dollar,” said a senior analyst at Forex club Andrey Shevchishin.

External trends also will affect dynamics of the currency market in Ukraine. In the case of the weakening dollar on the world market, the hryvnia will experience less pressure and Vice versa. Additional influence will have the dynamics of prices in commodity markets, particularly for grains, metal and ore.

The US dollar in the cash market in March may be 27-28,5 UAH, at the market clearing – 26,9–28,5 UAH. In the case of a negative scenario, associated, including, with falling exports (due to the blockade of the Donbas – Ed.) the course may go into the higher price range is 28.5-30 UAH per dollar.

In the optimistic development that assumes favourable seasonal factors, the receipt of IMF tranche and the resolution of the situation with the blockade of Donbass, the cash rate may strengthen to 26,5-27,4 USD per dollar.

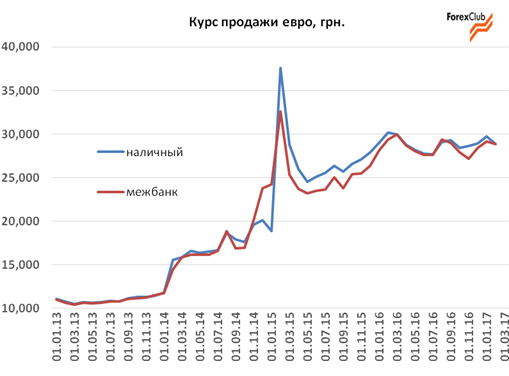

Euro in February on world markets fell against the U.S. dollar by 2% to 1,057. Pressure on the Euro had political risks in the Eurozone ahead of elections in France, the debt problems in Greece and Brexit. Selling rate of non-cash Euro in Ukraine in February fell by 1.2% to 28,83 UAH, cash – by 2.9% to 28.85 UAH.

The average selling rate of cash Euro in Ukraine on the basis of the baseline scenario can vary in the range of 28-31 grn.

The rate of sale of cashless Russian ruble in Ukraine in February rose 3.4% to 0,468 UAH, cash – by 1% to UAH 0,473. In relation to the U.S. dollar, the Russian currency strengthened 2.8 percent to 58,41 RUB.

Support the ruble had positive expectations after reaching an agreement the oil-producing countries on the freezing of oil production, as well as the period of tax payments.

The range of fluctuations of the selling rate of cash ruble in March 2017 can be 0,43-0,49 UAH. The average rate of the ruble against the U.S. dollar may reach 60,5 RUB.