Only one word — dividends. Nothing tells more about a tough fight taking place in Russia — the state’s economy, President Putin against state concerns, companies such as diamond monopoly ALROSA or the airline “Aeroflot”.

Putin money on the outcome, to put it crudely. Therefore, the Russian government last year ordered state-owned companies to significantly increase the dividends paid to investors — that is, including the Russian state. From 25 to 50% of the profit that they receive. The company did not agree, resisted. But the government has already budgeted in total 483,5 billion rubles. Without them, Putin will be a hole in the budget, which he is currently, apparently, otherwise patch cannot.

Gazprom hopes for leniency

That is, Putin increased the pressure on state corporations. Recently, the government finally ordered the payments. Anyone will be able to prove that he is not getting the necessary funds, he may be able to negotiate an exception.

One of such candidates is Gazprom. Last year the energy giant has paid 24% of its profits to investors. But now he begins to fight. Largest oil company Rosneft, apparently, will be able to pay “only” 35% of the profits. This is what concerns those who can count on a pardon. Others will be asked to pay. Everything points to the high dividends expected by analysts VTB Capital. According to their forecasts, companies listed on RTS, both public and private, increased its net profit last year, a total of 13%. Taking into account the different interim dividends this year they will get 17% more than last year. This occurred, despite the small recession that is still going through Russia.

Banks are once again earning more

Things are going better compared to last year, especially among export-oriented companies. This is connected among other things with rising prices for oil and metals. And banks earned significantly more compared to the disastrous year 2015.

This means that private investors can be happy. First of all, if they have shares of the diamond monopoly ALROSA and Aeroflot. According to a survey published in the newspaper “Vedomosti”, the company will generate the greatest revenues, they plan to “lay out”, at least 50% of its profits.

About alrose was known before. The company is still in 2015, is several times increased its profit last year increased seven times. For the airline “Aeroflot”, on the contrary, was not something taken for granted that the company in the past year will show a record profit of 38,8 billion rubles. After all, the last two years in a row investors were left empty handed.

Exchange goes beyond politics

Among private corporations, the highest profit received the company of the metallurgical sector. Leading metallurgical companies Severstal, NLMK and MMK, for example, which, like electricity producers have already fulfilled a large part of its investment program and have the means to payout as said Eugene Obydov of Analytical Credit Rating Agency (ACRA). The dividend earnings of these companies is at a level from six to twelve percent.

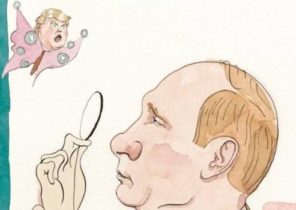

While high dividends in Russia corresponds to the world trend of development of the situation on the stock exchange are not affected. It is, rather, the political situation in the country. Over the past two quarters it was developed in line with the sentiment that the Kremlin has spread in world politics. After Donald trump was elected President of the United States, it was initially good. The fourth quarter ended with a profit of more than 16 percent for the full year profit was up over 50 percent. In addition to the victory trump, another event had a positive impact on development, the OPEC countries and several countries outside the organization, primarily Russia, agreed to reduce the level of oil production.

Putin takes Tillerson — despite the tough spirit

But what has become clear to Putin and the government that relations with the United States and the world with a victory trump does not improve, the stronger began to change the mood on the Moscow exchange. The RTS index has lost in the first quarter of almost three percent, the MICEX index, the calculation is made in rubles — as much as three percent. While cases in Western developed countries and some transition economies flourished in Russia, they began to decline.

The ruble is overvalued?

The ruble is now hovering. In the first quarter it appreciated by 7.7% against the dollar, it was the highest level since June 2015. But recently, he lost three to four percent against the Euro and the dollar. This is due to falling oil prices and a significant reduction in the key interest rate of the Central Bank — from 9.75 to 9.25%. As inflation in Russia at a low level, observers expect that this is not the limit. According to their forecasts, the key rate this year may be further reduced by ten percent. The Ministry of Finance and the already suggests that the national currency is overvalued.

In the stock market the second quarter began without much pulses. Although GDP after two years of recession growing, the growth is only one percent. The upgrade is expected rather in the second half will be “very moderate”, according to Sberbank CIB analysts. One thing all observers single — before the presidential election in March 2018 will not be running any of the necessary structural reforms. The Russian company and so learned to live with limited access to Western capital markets and reduced debt burden, says Andrey Marchenko, Director of the investment group UCP. Therefore, says Marchenko, they are better equipped to future shocks than some competitors.