In Ukraine for a few months will present a draft pension reform. Innovations in the pension sector became a “stumbling block” during the negotiation of the updated Memorandum with the IMF. In the final version of the document to remove the item, according to which the funded level of the pension system will work only after the elimination of the deficit of the Pension Fund (PF). A few weeks ago the Prime Minister Vladimir Groysman said that the “hole” PF “patch” only four years later, however, mandatory savings “for retirement” plan to introduce next year. The website “Today” figured out how the life of Ukrainians will change after the reform of the pension system.

Pension system “without Windows and doors”

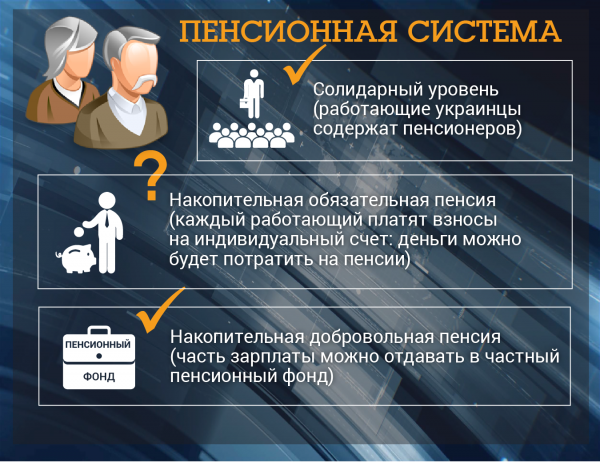

The pension system of Ukraine under the current law, must consist of three levels. Fully working only the first of solidarity. A so-called “contract of generations”. Working Ukrainians pay a single social contribution (ERU), the money in the Pension Fund and redistributed among pensioners.

The second level of the system (mandatory funded) trying unsuccessfully to run for many years. Last “major reform”, which included the launch of the second-level, conducted in 2011 at the time Deputy Prime Minister Sergei Tigipko. However, since then, the situation of the pension system has only worsened: the second level and not earned, and the deficit of the solidarity system reached a record 140 billion hryvnia. She funded system implies that part of their salary, the Ukrainians will be transferred to the individual account. The collected funds can be spent on reaching retirement age.

The third level – private pension funds – is still evolving. Of the 16 million Ukrainians officially working (data from the Ministry of social policy), which could potentially give part of their salaries to private funds, this opportunity was used only about a million people.

In the new government for the reform of the pension system took the Vice-Prime Minister Pavlo Rozenko. The current system compares the official with an unfinished house without a roof, Windows and doors. After a few months, the Cabinet promises to submit your version of the “reconstruction of the unfinished house”.

“So it was written out of the legislation, that the pension should consist of three parts, up to 60% – same level 30% – cumulative, of 10% private funds. And when we say: let us confine ourselves to the solidarity system, then we must admit that our resource – 60% of possible”, – said Deputy Prime Minister during a debate at the Institute Gorshenin.

How and why will change the joint level

Solidarity system is in crisis not only in Ukraine. The main problem is the demographic situation. Medicine does not stand still, working conditions are improved, as a result, people live longer. Moreover, women in developed countries are in no hurry to have children and do career. A generation of children is declining, while the elderly is not decreasing. In Ukraine now contain 10 employees, 11 retirees. According to estimates of the Institute of demography and social studies, by 2050, this ratio will become critical – 10 working will “feed” 15 retirees.

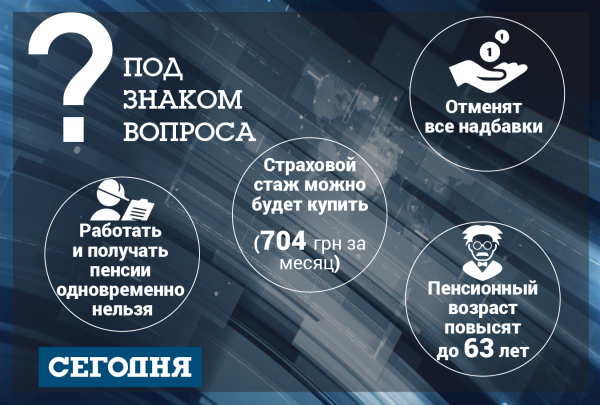

To reduce the number of Ukrainians “retirement” and increase the number of employees by increasing the retirement age. On this way went most of the countries of Europe. So, in the EU the average age of retirement has reached the age of 65. Moreover, the European Commission recommended to raise the retirement age to 70 years. Some Germans now retire at 67.

If Ukraine is to increase the retirement age to 65 years – the number of pensioners will decrease by one million. If to 62 years – 500 thousand, according to the Institute of demography. The question of the revision of the retirement age caused a heated discussion. For example, on the website of “Today” against this move made more than 85% of the 12 surveyed thousands of readers.

According to Rozenko, to raise the retirement age because of the short duration of life of Ukrainians. “I do not see the ability to adjust for age without an increase in life expectancy in the country. In men, it averages 65 years,” the official said. However, this Rozenko somehow operates not with data on the duration of life after 60 years, and calls the average age of living of Ukrainians. The latter takes into account the mortality at any age, including at birth. According to the Ministry of social policy, men who live to retirement age, on average live to 76 years and women to 80 years. That is, a Ukrainian man lives in retirement, not 5 years, as can be understood from the words of the official, and 16.

In the television broadcast, the Minister sotspolitiki Andrey Reva explained: to raise the retirement age in Ukraine is not necessary, as the government has other ways to affect the ratio of workers to pensioners. Now, of the 16 million employed ERUs are paid only 10 million, the others have the right not to pay and use this right. Among the “beneficiaries”, for example, several million farmers. In the Pension Fund Today said that at the moment the possibility to pay all ERUs.

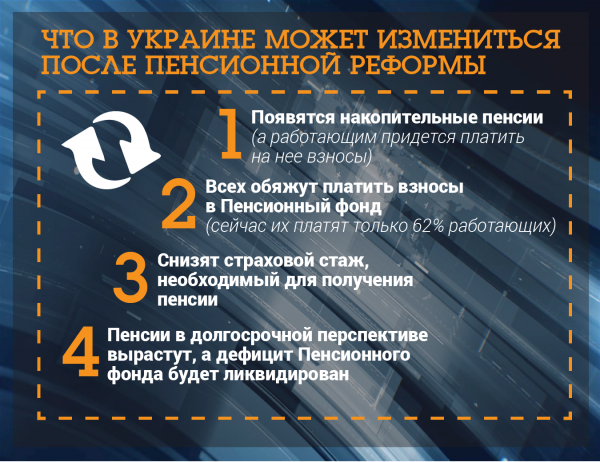

There are other innovations solidarity system. Missing insurance period can be purchased for 704 UAH/month. For example, if you do not have five years, you will have to pay 42 240 hryvnia. To learn more about how solidarity can change the system, infographic, prepared by the site Today.

Cumulative level: “for” and “against”

Recently the concept of introduction of the funded pillar of the pension system in the Gorshenin Institute presented the people’s Deputy from BPP Yury Solovey. “We believe that the new pension policy should be the introduction of mandatory funded pension system”, – says the MP.

There are several important “for” cumulative level: the Ukrainians will have an incentive to legalize their income in order to save funds on the individual account and the accumulated funds will work on the country’s economy. According to the announced the MP calculations, Ukraine due to the lack of a funded pillar of the pension system lost about USD 6.8 billion.

“We regulate that the yield on the bonds cannot be below the level of inflation. We must understand that money does not depreciate. Everyone has their personal savings account. Each month he receives SMS with information about how much to nakoil money. If a person is ill, he can use the money for treatment. If a person dies, the money does not disappear as it does now, but they are passed to heirs,” said the Nightingale.

When the cumulative level work, the Ukrainians will receive two pensions. However, this will not affect those already retired or will reach 60 years in the near future.

According to Rozenko, the cumulative level can be run in 2018. By the way, last year Deputy Prime Minister predicted the launch of the “elements of a funded system in early 2017”. In any case, the official said such plans. To implement these “plans” and failed.

After the reform, from 2 to 7% of salary (each year the interest rate will rise) will have to pay in the second tier of the pension system. Deputy Prime Minister suggests that the money can be taken from the personal income tax (18% of income). By the way, personal income tax Supplement local budgets, if 7% of the tax take on pensions, local authorities will have to “tighten their belts”.

An expert in the field of pensions, senior researcher of the Institute of demography and social studies Lydia Tkachenko says: to funded pension actually contributed to the welfare of Ukrainians, savings need to set aside about 40 years. That is to collect “old age” need 20 years.

Another disadvantage of the funded system – there is a danger that while Ukrainians will retire, withDr. paying money “eaten” by inflation, explains in an interview with “Today,” the Minister sotspolitiki Andrey Reva. The Minister reminds that in 2015 the inflation rate was above 40%. In Ukraine it is difficult to find a financial institution that is able to increase capital for the year at least 40%. Ideally, the money in the savings Fund should not simply compensate for inflation and to increase capital.

“What is the yield on the paper had to have last year, for RS 100, you have invested the year before? You can call structure in Ukraine, which 20 years is able to give at least 2% above the rate of inflation today? Nowhere to put it. Even if the money we hypothetically found, but to invest in the country nowhere. Let’s move abroad will saturate the economy?”, says Andriy Reva.

We will remind, in may the minimum pension in Ukraine will rise from 1247 to 1312 hryvnia, and in December – up to 1373 UAH. The average pension at the end of this year will reach more than UAH 2000.