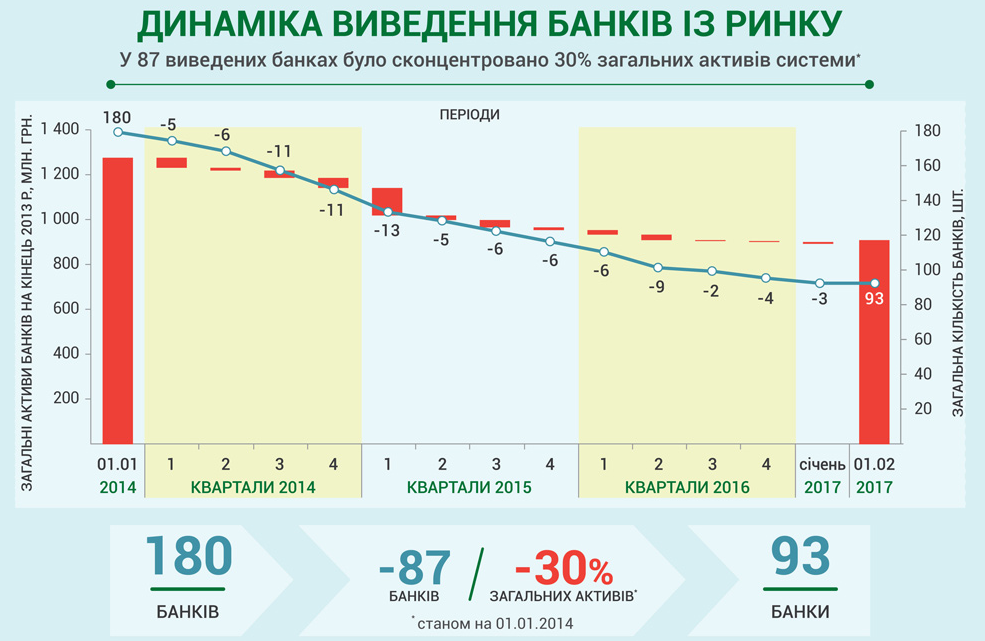

In the course of cleansing the banking system of Ukraine from the market were removed more than 80 financial institutions. Three years ago there were 180 banks, now there are 93 operating financial institutions. This was stated by Deputy head of the National Bank of Ukraine (NBU) Ekaterina Rozhkova.

“87 banks were withdrawn from the market. Of these, 14 banks solely for reasons of financial monitoring or fraud, 7 banks were placed and worked with the zone of hostilities in the Crimea, 5 banks left the market by the decision of the owners of 6 banks left the market because of opaque ownership structures. That is, 32 Bank left for reasons not connected with the crisis and financial problems. Some of them were created and had no model, others are engaged in illegal activity. Only 55 banks went for reasons of insolvency and liquidity,” – said Rozhkov.

Thus in wydanych market banks were skoncentrovana about 30% of all banking system assets. Characteristically, most of the financial institutions left the market in late 2014 – early 2015

As explained in the press service of the national Bank, the market is actively worked “banks laundries”, “vacuum cleaner”, “zombie banks” and is designed for profitable resale “baby boomers”. They are de facto already been bankrupt, but was maintained at “artificial breath”.

As follows from the report of the NBU, a large part of the closed banks were small. In addition, a significant portion of financial institutions prinadlejala “family,” politicians and ex-officials.

Rozhkov also added that the policy of cleaning of the banking system will change course to restore the banking system. Besides, the national Bank believe that the cleansing of the banking system will reduce lending rates and increase of trust of citizens to the owners of the banks.

“The cost of loans will decrease because the funds raised will be directed to the domestic market, and not to appear abroad. Customers of all banks will know their real owners, and therefore be able to make their own conclusion whether they trust the shareholders. Ustoichivosti banks to macroeconomic shocks has increased, banks will have sufficient liquidity and capital to work steadily even in a recession”, – the Chairman of the NBU in its report.

Earlier it was reported that for the year 2016, the banking system of Ukraine has received a loss of 159 billion UAH, which is a historical record.