After the financial crisis appeared the myth that conservative governments tend to reduce government spending, always have budgetary discretion, while to be targeted to the redistribution of income progressive governments large budget deficit is the best “free lunch” in the world. This simplistic attitude may contains a grain of truth, but it completely overlooks the true basis of political economy of the budget deficit.

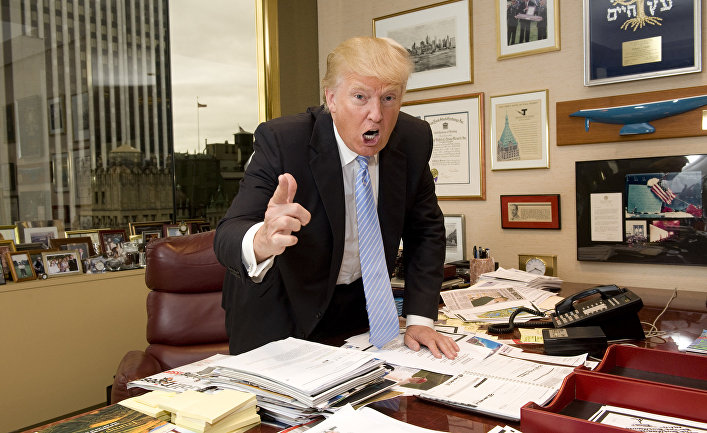

The facts are that as only one of the parties gets a solid control over the power, her face strong incentives to Finance their priorities in debt, it being understood that not necessarily it will have to pay the bill. Therefore, it is expected that the administration of the future US President Donald trump (conservative or not) will start to aggressively use fiscal deficit to Finance its priorities in the tax policy and government spending.

The most accurate framework for thinking about the budget deficit in democratic countries was proposed in the late 1980-ies Italian scientists albert Alesina and Guido Tabellini and about the same time, the two Swedes — by Torsten Persson and Lars Svensson. Although their approaches are slightly different in detail, the basic idea was the same: while you can, you give money to your friends. If then, when came to power the opposition party, it turned out that the money became less, well, tough luck.

Just remember recent economic history of the United States, to confirm the conclusions of the Italian-Swedish model and see the absurdity of claims that the Republicans always seek to balance the budget, and the Democrats are always trying to spend more than have of the country. In 1980-e years the hero of the conservatives, Ronald Reagan was willing to accept a huge budget deficit to Finance its ambitious plans to reduce taxes, and he did it in an era when borrowing was not cheap.

In the beginning 2000-x years of another Republican President, George W. Bush essentially repeated the scenario of Reagan, again reducing taxes and increasing the budget deficit. In 2012, just when the confrontation between the Congress, controlled by Republicans, and President-Democrat Barack Obama on the question of the size of the deficit and public debt reached a peak, Republican presidential candidate MITT Romney delivered an economic program, which included a huge increase in the budget deficit for financing of measures to reduce taxes and increase military spending.

On the other side of the spectrum, the President-Democrat bill Clinton, whose presidency most economists consider to be extremely successful: he has managed to achieve a budget surplus. Moreover, at the end of 1990-ies some analysts have even begun to think about how it will operate international markets if the US government is gradually getting rid of all your debts. Subsequent tax cuts and unwarranted wars under Bush assured the absence of such problems.

What, then, prevents the deficit to skyrocket upwards, as the parties change each other in power and is in debt to support its supporters? In functional democracies, for example, in the US or UK, there is enough collective memory on the problems associated with high debt, which provides some support for periodic measures to reduce the ratio of debt to GDP. But even in the United States and Britain’s budget deficit is not sterile and neutral form of economic incentives in accordance with the standard Keynesian model. On the contrary, the budget deficit is almost always the product of hard political internal struggle on the question of budget priorities.

Of course, in a constantly changing world the cost of servicing a large debt burden may eventually change. Interest rates declined for several decades and now suddenly began to grow again.

In the perennial dispute about what amount of incentives is optimal, the Central factor is the different attitude to risk. Until recently, many economic commentators with left-leaning demonstrated the necessity of large-scale fiscal stimulus in the US, although they seem to have changed their position overnight (or rather the night, when he was elected trump). No one ever really knows what should be a reasonable compromise between the size of the debt and incentives.

Nobel laureate in Economics Thomas Sargent with colleagues recently argued that the optimal debt level for the United States in fact is almost zero, although it is not recommended to achieve this level in the foreseeable future as the U.S. national debt now exceeds 100% of GDP. The recommendation of the Sargent contrary to the opinion (supported recently in an editorial in the Economist) that all developed countries instead of trying to stabilize the size of the debt, should try to copy Japan, where the net amount of public debt exceeding 140% of GDP (the highest level among developed countries).

But it’s not just the size of the debt, but also how to manage it. This question I explored in a recent article dedicated to the proper combination of the amount of long-term and short-term hozaystvennih. Some experts, including Robert Skidelsky, seem to believe that all this discussion about the methods of managing maturity structure of government liabilities is in a sense a cover for a tight budget policy and reduce government spending. However, if in the era of trump’s interest rates jumped dramatically (as is quite likely), then the US government will regret to prefer short-term debt and less long-term.

If a trump presidency will lead to a massive increase in borrowing, as well as to accelerate the pace of economic growth and inflation, this can easily follow the sharp rise in global interest rates, which will create a tremendous strain on the weak locations all over the world (for example, the market of public borrowing Italy), as well as in the market of corporate debt of developing countries. Many countries growth in the US will be beneficial (unless, of course, trump is not at the same time put up trade barriers). But anyone who hopes that interest rates will remain low, because conservative governments have avoided budget deficits, must first learn the lessons of history.