In the market for the sale of real estate traditionally, summer is a lazy season. But in 2017 the situation with the activity of buyers looks different. About this according to a study conducted by analysts m2bomber.

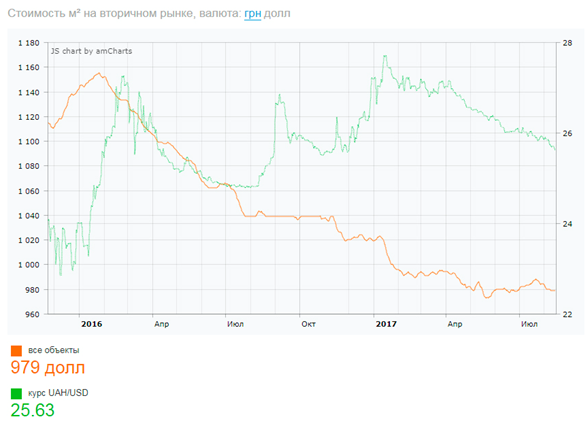

Secondary market, which is historically tied to the currency fell to a late spring 2017, experts say. And in the summer began to stabilize requested by the sellers prices, and now the median price per square meter in Kiev is equal to 979 USD. on the secondary market. In the primary market of Kiev, the median cost per square meter is 20 UAH 699 and when converted at the rate of NBU is 808 USD.

“Due to the prolonged difficult economic situation in Ukraine, the demand for housing today is not great. Some stabilization of prices in the real estate market in early summer is situational, and rely on the continuation of this trend should not”, – analysts say.

Your prediction can be explained by the lack of financial savings the majority of the population, the low pace of reforms and absence of a mortgage.

“So by the end of the year we can expect a further gradual decline in prices for secondary and primary housing. … There are serious grounds to speak about the rising cost of real estate in the next few years.”, – analysts summarize and list the main factors that can affect the market in the future:

- Exchange rate fluctuations and inflation

“The US dollar rate in the budget of Ukraine for 2017 laid down is equivalent to 27.2 UAH. For quite a long time since the beginning of the year the hryvnia is more “expensive” position, and therefore, it is likely that closer to the end of the year the hryvnia will fall below 27 UAH per dollar. Plus, you need to consider that the autumn is often “turbulent” time of the year for the national currency.Also there is a fear that inflation this year will be higher than expected: the forecast, the NBU is 9.1% but economists say the inflation rate of 12-14% by the end of the year. Thus, savings will go to fight for survival, not for the purchase of comfortable housing”, – analysts say.

- Growth proposals and budget accommodation

“Competition is growing among developers, including those who are actively developing suburb. So developers have to develop sufficient infrastructure because the buyer willing to put up with the remoteness of the town only if all the elements of civilization will be close to home. You also need to consider that in the current year, the market is filled with affordable housing options. It concerns adopted in April 2017 of the law on privatization of dormitories. Count on the fact that the family of the factory workers will choose to buy a new apartment, not privatization Dorm room not worth it” – experts say.

- Low demand and lack of mortgage

“Mantra “real estate has bottomed” once again questioned the solvency of the buyers to purchase housing they are not in a hurry, and announced in early 2017, the return of mortgage lending is not as attractive to prospective buyers because of their rates. In Ukraine, the average interest rate on mortgage loans is more than 20% per annum. When a large percentage of the down payment (30-50%) the final cost of flats will be prohibitively higher than the original. Most families with average income can’t afford to spend around 10 000 per month to pay the mortgage for a Studio apartment. Understanding this situation, to stimulate the sales come from the developers themselves, who began to offer clients the installment plan. And if, for example, 5-6 years ago, the typical leasing period was up to 3 years, in the last 2 years for some developers payments already divided for 5-10 years” – suggest experts.

- Low attractiveness of Ukraine as a country for investment

“The foreign partners take a wait and see position and begin work with Ukraine slowly. So, incomes in dollar terms to increase in the next year or two will not be”, – experts say.

- The “elections-2019” and payments on foreign debt

“A year before the election, the government will seek to increase social benefits, what will happen with some delay to put pressure on the exchange rate. Pressure also will have a relatively large payout, the upcoming Ukraine in 2018-2020 on external debt” – analysts say.

We will remind, at the same time, in Ukraine, according to experts, considerably will increase the price of rental housing. In the segment of budget accommodation prices soar for a few weeks by 10-30%. The apartment, which now rent for 5 000 UAH, after a few weeks can cost 5 500 to 6 000 UAH, told capital realtor Maxim Baborak.