In Ukraine already this year, promise to submit a draft of the fundamental reform of the pension system. At the moment, pensions in Ukraine are among the lowest in Europe – the average pension in this year reached only 1800 UAH, and the minimum – 1247 UAH. The main innovation that announce for a few years – the introduction of the funded pillar of the system. In addition, experts discuss the need for raising the retirement age. The website “Today” figured out how and when Ukraine may change the pension system.

What will change

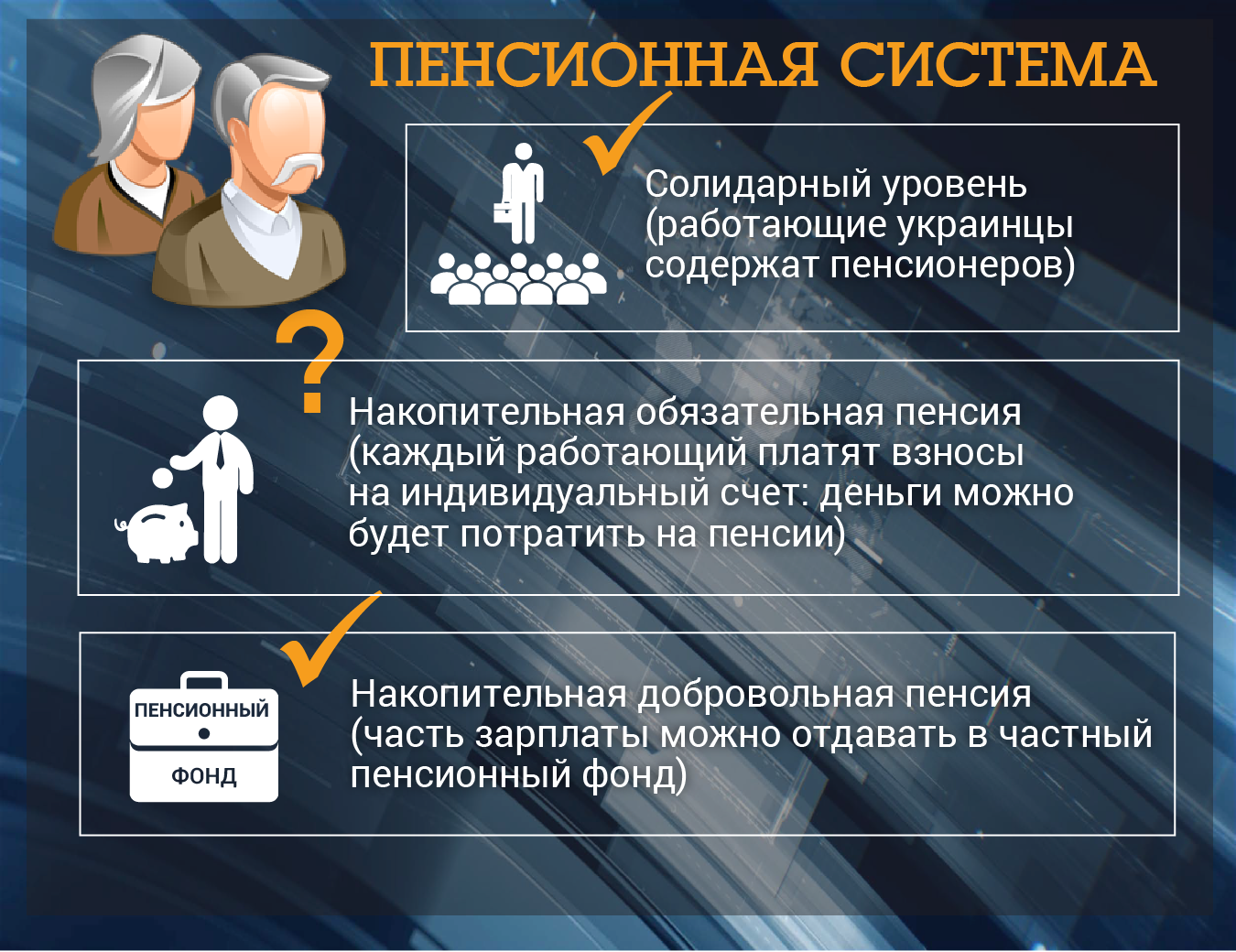

Earn a three-tier pension system. “I believe that the ideology of development a three-tier pension system, providing for the introduction of the funded pillar and the development of private pension insurance, can be a wonderful basis for further pension reform in Ukraine”, – said recently the Vice-Prime Minister Pavlo Rozenko, who oversees the government’s social policy.

Now of the three possible levels in the pension system of Ukraine is working fully. “Solidarity pension system is based on the fact that working people pay contributions to the Pension Fund or the budget and these contributions funded pension. There is a certain contract of generations”, – says chief of the country demographer Ella Libanova.

According to experts, the “right” to work in solidarity level will be provided only if working in the country more than pensioners. In Ukraine all on the contrary: the contributions to the joint level pay 10 million Ukrainians and receive a pension of 11 million people. Size social contribution – 22% of salary. While 40% of Ukrainians pay “tax on pensions” with the minimum wage – and it’s only 704 of the hryvnia.

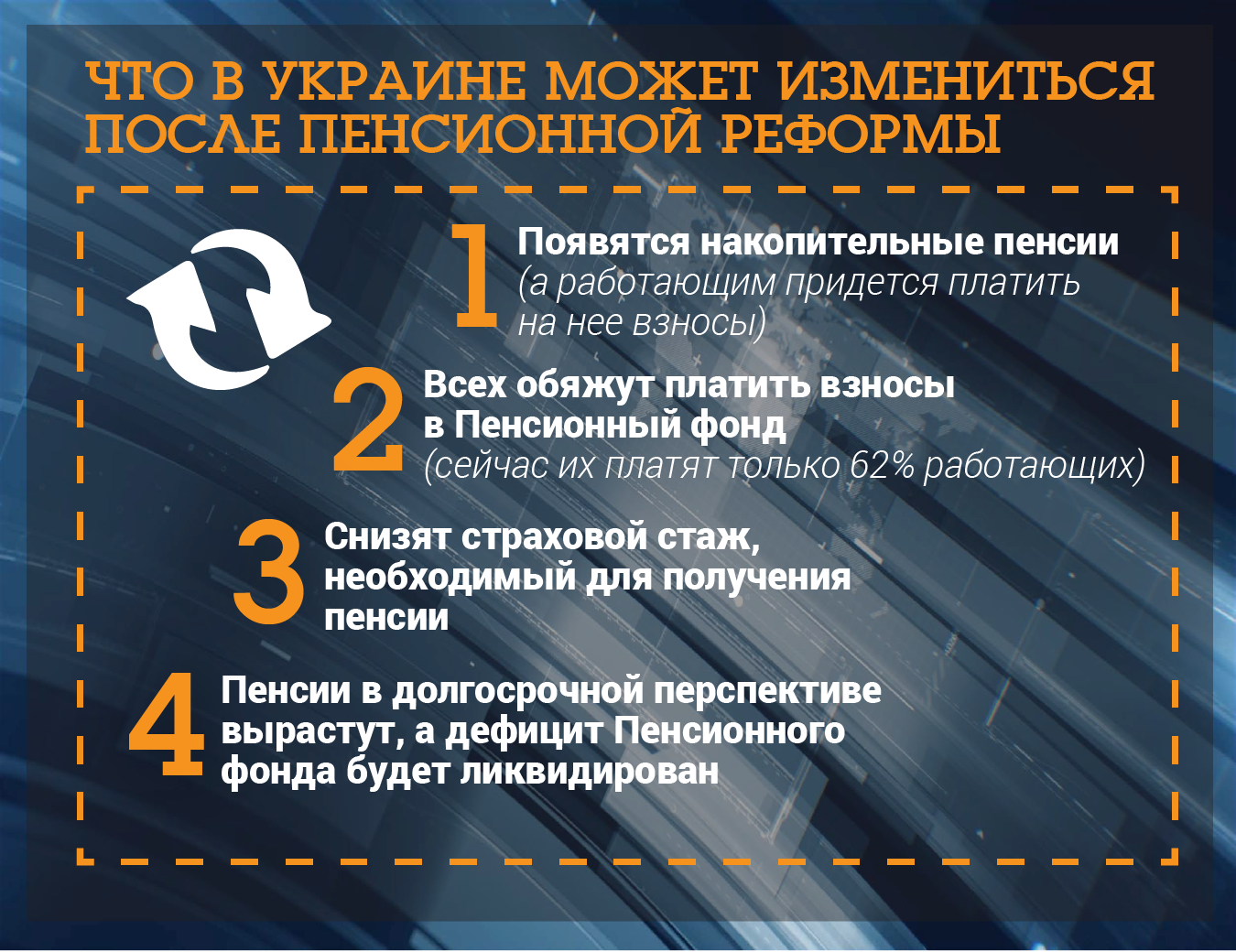

In such a situation, the deficit of the solidarity system are inevitable. Last year it reached 145 billion, and in 2017 will reach 142 billion. The main reason for the “hole” in the budget PF – reduction of social contribution rates from 38% to 22% at the beginning of last year. There are other reasons: low salaries and difficult demographic situation.

Mandatory funded pension in Ukraine plan to introduce by Deputy Prime Minister Sergei Tigipko, however, at the moment, “the second level” is still in the plans. Says Minister sotspolitiki Andrey Reva, there are several problems that stop the start-up of funded pensions. So savings are not “ate” inflation, money should “work”. It is difficult to find the structure, the Minister said, which could increase investment every year to compensate for inflation. The second problem – according to Reva, the cumulative level cannot start until then, until will not be eliminated the deficit of the solidarity level.

“You can accumulate when you have a surplus. Surplus no. It is clear and obvious. Now the second. What is pension savings? It’s not a Bank is an investment Fund. That is, he can’t chase maximum profit at the risk of your money. He must get less profit, but guaranteed for 20 years. That is, I can then invest money and not lose and even something to buy. We are in 2015, the inflation rate was 49%. What is the yield on the paper had to have last year, so you don’t lose the 100 USD, which you put in last? You can call structure in Ukraine, which 20 years is able to give at least 2% above the rate of inflation today? Nowhere to invest,” the Minister said in an interview with “Today”.

If the cumulative level work – Ukrainians will receive two pensions. However, the modern Ukrainians, “retired” will not touch it – their only source of income will remain the joint level.

Non-state pension funds their money was entrusted with about one million Ukrainians. “People today can pay to such a Fund and make an additional contribution. Due to this, the pension will be higher. Unfortunately, we have the third level is underdeveloped. A small number of participants (a total of one million people) and lack of development Funds themselves,” – said the Deputy Chairman of the PF Mykola Shambir.

One of the largest private pension funds in Ukraine, if every month to invest 300 hryvnia, in 30 years, promises to “earn” for the investor of several million hryvnia, the money will be available after 60 years. However, no one can say that after 30 years can be bought for a few million, and won’t close it until that time Fund.

The author of the book “Towards the future. Guide to non-state pension funds,” Alexander weaver advises: choosing NPF, you need to pay attention to the following factors:

- When the Fund was established

- Who established the Fund

- As the Fund survived the crises of 2008 and 2014 years

- What is the net unit value of pension contribution

“If the Fund was established in 2007 year, then the net cost of a unit, for example, was 1 hryvnia. Now if the net value of the units is 2.5 hryvnia, then it is an indicator,” – says the expert.

To pay fees oblige all. Now 16 million Ukrainians social contributions are paid only 10 million people. Farmers, service workers, and other categories have the right not to pay fees. As told “Today” in the Pension Fund, at the moment officials are considering the possibility to oblige to pay a tax to the pension Fund of all working Ukrainians without exceptions. “In the world applies the obligation of payment of insurance contributions for the whole working population. We’re still studying this and other methods. But there are methods, such as voluntary involvement, and compulsory payment”, – says Mykola Shambir.

It should be noted that not all social contribution goes to the PF budget. The money is distributed between three funds: insurance in case of unemployment (there goes a 6.3%), insurance disability (11.1%) and pension insurance (82.5% of ERU, last year – 78.5 per cent).

Will reduce the insurance period required for obtaining retirement pension. A few days ago on the website of Minapolitan appeared specific steps included in the pension reform. However, later the publication was removed. The report said that in 2021-m retired can qualify for the Ukrainians, with a total working experience of no less than 30 years, those in the country only 8%.

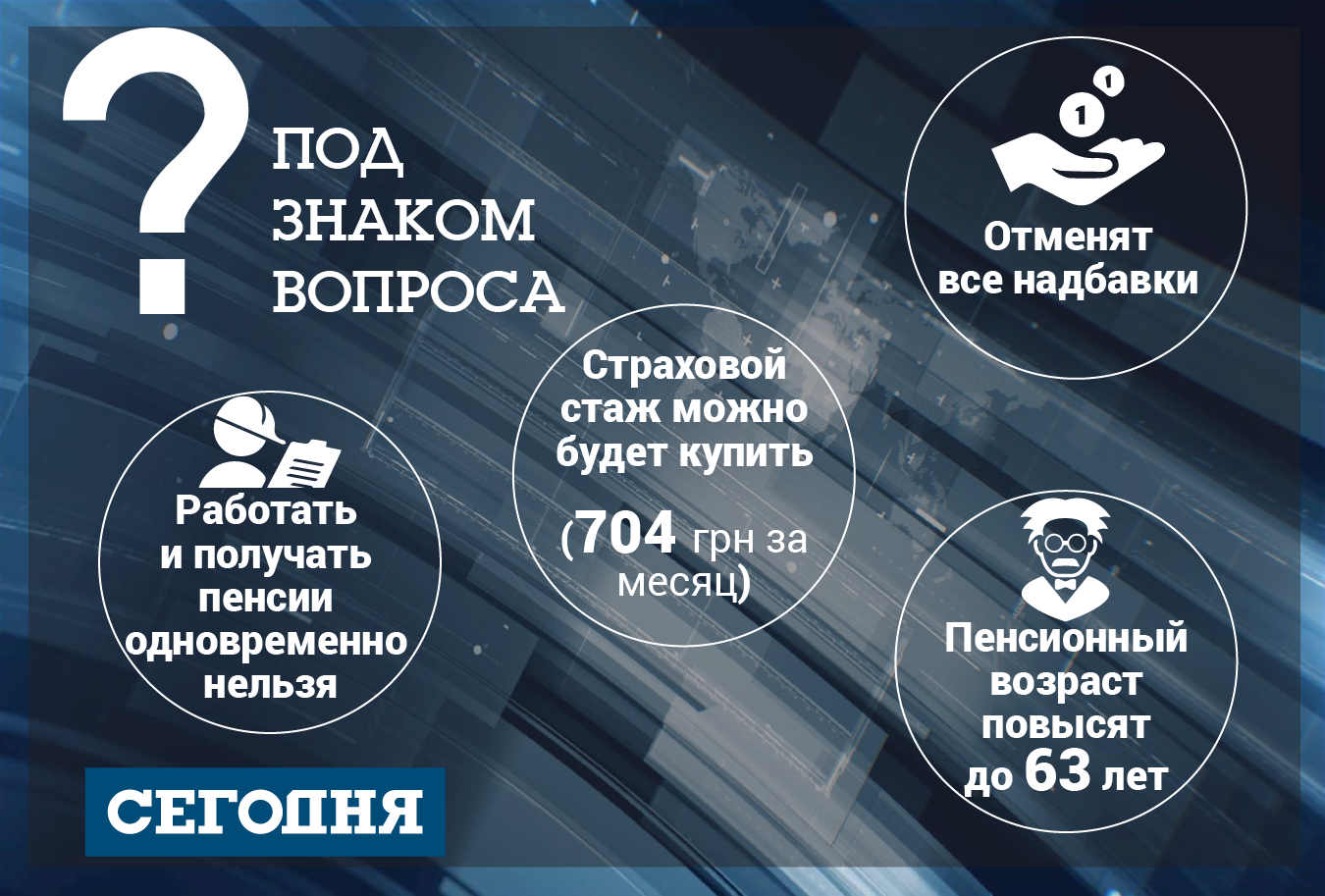

Under the project, the insurance period will be reduced to 15 years from the first of January 2018. This provides the opportunity to buy itself 15 years of insurance experience. “This amount will make about 130 thousand UAH: hryvnia 704 for each month is multiplied by 15 years”, – stated in the message.

The retirement age of all the early will have to increase

In the European Union the average age of retirement has reached the age of 65. Moreover, the European Commission recommended to raise the retirement age to 70 years. The Germans now retire at the age of 67. Of all the European countries early retirement age occurs the Ukrainians – in 60 years. In Belarus, President Alexander Lukashenko, the retirement age increased by five years.

Raising the retirement age – a necessary step, which are all developed countries. This is due to the global trend of population ageing. A generation of children is declining – the Ukrainians as Europeans, are in no hurry to have large families, while the elderly is not decreasing. Now in Ukraine the ratio of pensioners and employees, who pay contributions to the Pension Fund, – 11 to 10. If the situation does not change, according to estimates of the Institute of demography and sociological research, in 2050, ten Ukrainians will have their taxes contain 15 seniors.

On raising the retirement age in Ukraine the IMF insists. From their point of view, it is a normal step, says senior researcher of the Institute of demography and social studies Lydia Tkachenko. Such a recommendation, the expert said, has been voiced several times already.

As explained by an academic, raising the retirement age will reduce the number of pensioners and increase the number of working Ukrainians. According to estimates of the Institute of demography, if you increase the retirement age to 65 years – the number of pensioners will decrease by one million. If to 62 years – 500 thousand.

“International standards like the Convention on social security, suggesting that retirement age is 65 years you can set no matter what the circumstances. In fact, to say that direct limits in international practice there. Low retirement age is not accompanied by a prolonged lifespan. People who live to 60 years, with the same probability will live up to 63 years”, says Lydia Tkachenko.

An expert in the field of pensions Alexander weaver also believes that raising the retirement age will improve the situation, but will not save the pension system of Ukraine. “After raising the retirement age, the threat will recede, but the revision of the retirement age – a move aside the threat at the time. In itself, the increase is a large effect will not give. We need to move from solidarity principle to cumulative,” says Alexander weaver.

In the Cabinet say, to raise the retirement age Ukrainians will not.

What will happen to the pension system of Ukraine: experts and officials

Volodymyr Groysman, Prime Minister

“We are thinking very seriously over the pension system. It is unfair and seriously populist formed. It gave us huge challenges…our Next step is to change the country’s pension system, to make it fair and to fill its life”, – quotes the words of Groisman, the press service of the Cabinet.

“I believe that in 2017 we have every reason to say that will change the pension system, and it will be fair, and retirees will feel the increase in pension payments, but the system needs to radically change, and we are ready to offer Ukrainian society such decisions. All in due time”, – said the Prime Minister at the government meeting on the eighth of February.

Mykola Shambir, Chairman of the PF

“It all depends on what we mean by pension reform. The introduction of a funded level – in fact it is something that the law already decided in 2003. But the date of its launch has not been defined – and in fact it has not yet started. As for the ready-to-run cumulative today, of course, one of the conditions for running a funded level is balancing the solidarity system-that is, getting rid of the deficit or its reduction.

That is, there should be no significant problems. Of course, it is, in fact, a condition that extends and the International monetary Fund: first, balance the solidarity system, because talking about accumulation. That is why we believe that in the first place now need to work out issues via the solidarity system and gradually approach the launch date”.

Lydia Tkachenko, academic

“Of course, to change something you have to. You can, of course, reduce the number of pensioners. The same increase in the retirement age – it’s what makes? It reduces the number of pensioners and, roughly speaking, shifts, or stretches of the working period. This reduces the period of retirement. We have now women live in retirement on average for more than 20 years. And men, for all that, they have higher mortality rates, more than 15 years. Ie, men who lived to 60 years will live an average of more than 75 years.

I think we need to raise the retirement age. It is not for those people who have now retired, and not even for those who are now approaching retirement age. The decision you make today, and start improving later. It is possible to identify a generation, say, born в1990-s – early 2000-ies, and assign them a higher retirement age. These generations are the most small, and yet they will shape the workforce, the burden on the pension system will be “off scale”. If them not to raise the retirement age, will have to raise taxes and the rate of ERUs. When these small generation will retire (this will be the end of the 2050-ies), there will be a slight easing of tension and you can pay them more generous pensions.”

Galina Tretyakova, an expert in the field of pensions

“To make it so that pensioners receive a decent pension only due to the social system, is impossible. To this conclusion came 20 years ago, but nobody had the political will to change the situation. To make pensioners rich, you need to run two more columns: mandatory and voluntary funded’t drop”.

“My argument in favor of a funded system is very simple. If you are running a solidarity system, to ensure the replacement rate of 0.6 (i.e. the pension will be at 60% of salary – Ed.) running generation need to deduct 32-36% of salary. And in order to provide the same replacement rate under the funded system you have to pay 0,12-0,17% of salary. We propose to leave the joint system and to introduce a funded while at small levels.”