The Cabinet of Ministers a few days ago, the Ukrainians presented a draft pension reform. If the innovations will support the Parliament in October of this year to pay pensions will be new. The website “Today” to find out what payments you can calculate the Ukrainians after the reform and who will lose.

How to count pension

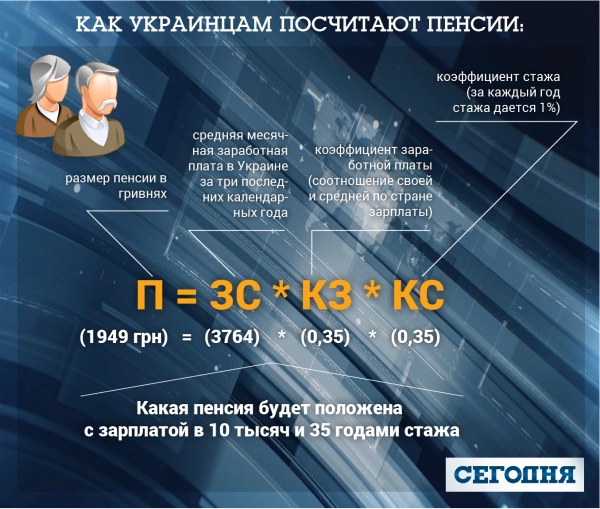

The Ukrainian pension depends on three indicators: the average wage in the country, their salary and seniority. According to the law “About state pensions”, the pension is calculated according to the formula: N = CS x a x KZ KS

P – pension amount in UAH;

AP – the average monthly wage in Ukraine for the last three calendar years

KZ – coefficient of wages (the ratio of its average country wage)

COP – coefficient of experience (for each year given 1%)

The average salary for the last three years reached 3764 hryvnia, according to the Pension Fund. The approximate ratio (KZ) his salary can be seen by comparing its size with the average around the country. And in order to determine the factor of seniority (CS) you need to multiply your experience by 1%. At the moment the Pension Fund in the calculation of pensions multiplies the experience by 1.35%, but within the framework of the reform, the ratio will reduce.

For example, we calculate the potential size of the pensions of Kiev with an average salary and 25 years of experience. According to the State statistics service, the average salary in the capital – 11 010 hryvnia, and the average salary in the country – 6 752 hryvnia. If you retire before the reform (October 2017), the amount of the pension will be approximately 1987 hryvnia, and if after October – 1505 UAH. In addition, if in 2018, for old-age pensions 25 years of experience, with each year of “bar” will raise by one year. Already in 2028-m in order to earn a pension you will need 35 years of experience.

But for current retirees, a new formula for calculating pensions will significantly increase their income. Part of the Ukrainians receive a pension based on the average country wage in 1917,9 the hryvnia, and after the “modernization” of the pension they would recalculate based on the average wage 3764 hryvnia . This figure has not been updated for several years. For example, a Ukrainian who retired before 2008, received a salary 50% above average and worked for 25 years, currently receives the minimum pension – 1312 hryvnia. And after “modernizing” the pensioner can claim 1411 USD.

It is worth considering that to the average salary of Ukrainians, even after the “modernization” will receive the minimum or close to it payments.

What else will change

The retirement age will increase, but not all. If by 2028 to accumulate only 30 years of experience, will either have to buy the missing experience, or to work to 65 years. In the presentation of the Cabinet says that in 2028 at age 60 to retire will be able to reach only about half of Ukrainians of retirement age. 40% will go on a holiday in 63 years, 5% in 65 years. Those who to rework not want to buy experience – one year is 16 896 USD. Prime Minister Vladimir Groisman said that talking about raising the retirement age reform is not. But, in fact, half of Ukrainians retirement age still increased.

Those who do not have the right to a retirement pension due to the lack of experience is social assistance in the amount of 30% of the subsistence minimum for the disabled. At this point it is from 400 hryvnia per month. “Social pension” in Ukraine receive less than 100 thousand Ukrainians. After tightening the requirements for obtaining old-age pensions, the number of “social seniors”, experts suggest, may rise several times.

The Ukrainians, who have not yet retired, found themselves in a losing situation. Senior researcher of the Institute of demography and social studies Lydia Tkachenko sure that the reduction ratio of insurance – “daylight robbery” in relation to those who have not higher to retire. “Really, will use the updated wage base, but they want her for a number of years to freeze. Everything is done in manual mode, and for new pensioners it is a daylight robbery,” – says a scientist.

Pensions will “modernize” every year. At the moment of retirement Ukrainians grow annually at the inflation rate. If prices rose 10%., 10% from the minimal salary raise for the disabled and pensions. As explained in the Cabinet, after the adoption of reforms to “modernize” the payments will be in an amount not less than 50% of the average wage growth and 50% inflation. “We are laying the automatic rate – 50% growth in the average wage and 50% inflation, no less, and perhaps even more – on the required annual pension modernization”, – said Prime Minister Vladimir Groisman.

Hwhat to do if not enough experience

If not enough experience, there are three options for how not to remain in his old age without means of livelihood: buy experience to work after 60 or to postpone retirement on their own. In addition to pension from the state, there is also the possibility to get money from non-state pension funds (NPF). Opinions on whether to trust NPF, diverge. So, the Minister sotspolitiki Andrey Reva is sure that you can trust the private funds, like other financial institutions, it is impossible. “My grandmother was 7 thousand rubles in 91-m to year. And then they one day disappeared. All that all her life she had been saving for old age is gone. I was 25 years old, I came to it, came unexpectedly – she back to me stood. She just stood there and cried. Silently, so quietly, so no one saw. This is the picture I remember today. Today to convince me that we need to invest in our financial institutions very difficult,” – says Andrey Reva.

At the same time, the expert of the Reanimation package of reforms Galina Tretyakov is sure that the pension funds are the only opportunity to receive a decent pension. The expert notes that in an ideal situation to be two sources of income – pension from the solidarity system (what the Ukrainians are now) and the pension accumulation Fund.

Non-state pension funds diversifitsirovat their assets – that is, invest in different areas: securities and metals, deposits and real estate. For example, one of the largest Ukrainian banks offers investors to set aside each month 200 hryvnia “old age”. If you save for 30 years, by 2047-th can be obtained every month, 113 thousand hryvnias (monthly NPF promises to earn 20% of the Deposit amount). Don’t know what I can buy with the money in 30 years.

The author of the book “Towards the future. Guide to non-state pension funds,” Alexander weaver advises: choosing NPF, you need to pay attention to the following factors:

- When the Fund was established

- Who established the Fund

- As the Fund survived the crises of 2008 and 2014 years

- What is the net unit value of pension contribution

“If the Fund was established in 2007 year, then the net cost of a unit, for example, was 1 hryvnia. Now if the net value of the units is 2.5 hryvnia, then it is an indicator,” – says the expert.

According to Alexander Weaver, 2003 year (at this time began to appear NPF) none of the Fund has not been declared bankrupt, depositors can withdraw their funds at any time. In addition, if the founders decided to close the NPF, the accumulated money will be transferred to another Fund.

To postpone retirement, according to the expert, even five years before retirement age. The sum of the contributions have no limits. The founder of the training center “Cashflow Ukraine” Alexey Polovinkin sure, you need to postpone every month not less than 10% of income.