Ukrainians less to borrow money from banks (over three years the level of debt load of the population fell by almost 5 percentage points from 13.5% to 8.8%) and more — from friends and relatives, and try to borrow 1-2 thousand UAH, and not in the currency, and without interest. Such conclusions can be drawn from the study “GfK Ukraine” commissioned by the World Bank of consumer credits to the population, conducted in December 2016 — January 2017 and presented recently. On the basis of “Today” made a portrait of the “average” resident, who lives a loan.

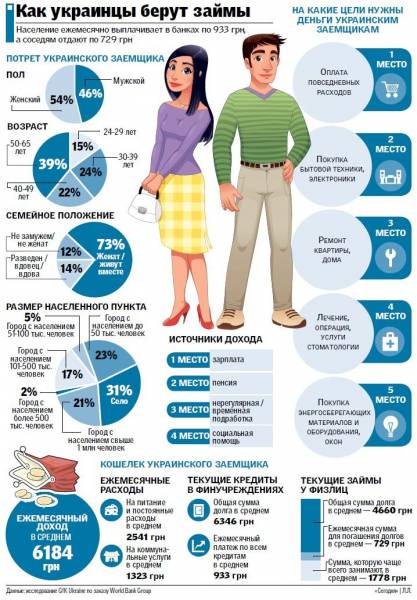

PORTRAIT. As explained in the “GfK Ukraine”, their target audience — people who pay a loan or borrowed not less than two years ago. Respondents were 2140 people aged 24-65 years in all regions of Ukraine. As you can see from the infographic, the average borrower is a married working female citizen aged 40-65 years. She borrows money from a Bank or from friends, amount from 250 to 10 thousand UAH for a period of less than a year as consumer loan (no mortgage and no car). This is at least the second loan for the last two years. Nearly 60% of borrowers are calculated in time. While 70% of respondents, no Deposit, no stashes, 23% only have a stash, and only 7% have both, but still they sometimes have to borrow.

WHO AND THAT. Usually the “average” borrower borrows money from friends or relatives, and is trying to take them without interest. Of these people 52% of the total, and they borrow a little from 250 to 2500 UAH for 2-3 months, so contact the Bank don’t see the point. Banks credited 72% of the total number of borrowers in the amount of 5-10 thousand UAH and above, and for a period of a year or more. In total more than 100% borrowers, but according to analysts of the “GfK Ukraine” is understandable, because the same people take out a Bank loan, and in interest-free loans from friends for the early repayment of the debt to the Bank. Often lend for the purchase of fully equipped, celebration, treatment and repairs.

EXPERTS. Financial experts say that the cost of the loan today high (30% per year or more), so the lending rates are falling, people aren’t willing to overpay. “The situation with the protection of creditors’ rights is critical, banks mired in lawsuits with malicious defaulters, and using a leaky legislation, not return loans — told us the head of the Council of NABOO Roman Shpek. In the end, banks are not lending, because they do not believe that the loans will return. And the business is not growing, because not enough funding, in the end, all this leads to a falling solvency of the population. So do not expect to resume longer-term lending — loans and mortgages. Without a law that will make it impossible to use schemes to evade the implementation of credit obligations, the situation will not change.” Economist Ivan Nikitchenko said: we need laws, regularuse relationships between banks and customers, in particular, the law on collection companies. “It is necessary to carefully prescribe the conditions for servicing loans and to lower interest rates. Only a few years, when rates will be slightly higher than inflation (plus 2-3%), occur credit boom, which was in 2005-2008”, — said Nikitchenko.