The pension system in Ukraine is in a catastrophic situation, says the Ministry of social policy. Despite the increase in the minimum wage and taxation of all natural persons entrepreneurs, the Pension Fund deficit this year will reach 141 billion hryvnia. The government is preparing a reform, which, according to him, will allow not only to reduce the “hole” in the budget, but to increase pension. The website “Today” figured out how in different countries of Europe earn retire and how are the Ukrainians.

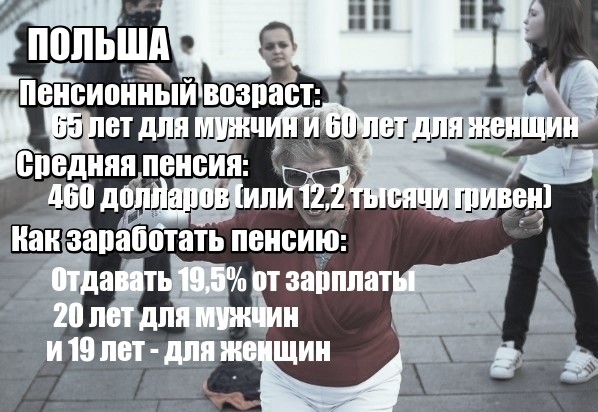

On average, the poles retired get $ 460. Compared to neighbors in the EU, it is a small amount. However, it is worth considering that prices are lower in Poland than, for example, in Germany, in addition, the Polish pensioners enjoy the benefits. After 75 years of free medical care, almost all pensioners – free public transport and concessions for medications.

Poland has three-level system: a shared, cumulative and individual. If you invest in the three Fund part of their salary for life, after 60 years for women and after 65 for men, you can get three pensions.

Mandatory conditions for retirement pension – a minimum of 15 years of experience for women and 20 for men. Contributions to the Pension Fund by a few percent lower than Ukrainian is 19.5 to 22%. With half of this amount to the poles paid by the employer.

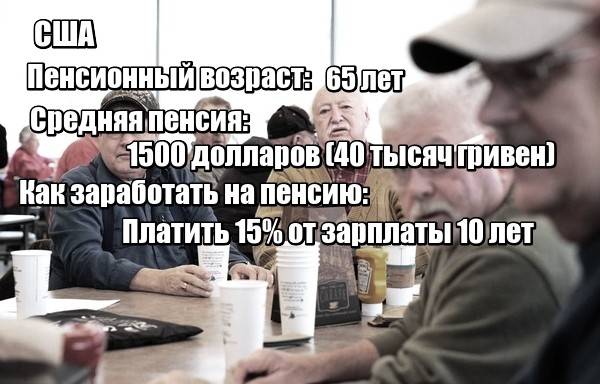

The average pension in the US – $ 1,500. This amount is sufficient for a comfortable life in nearly all U.S. States, provided you do not need to repay the mortgage or rent housing. For pensions requires at least 10 years to defer 15% of salary. From 1935 here is the Law on social security, signed by Franklin Roosevelt (Social Security Act).

The tax code allows Americans to contribute to their personal pension accounts part of the salary before tax to income tax. There are solidary and accumulative pillar of the pension system.

The government says that the retirement age for Americans will gradually increase to 70 years. Now for a full pension you need to work to 65 years, however, U.S. citizens have the right to retire early, however in this case the payout will be less.

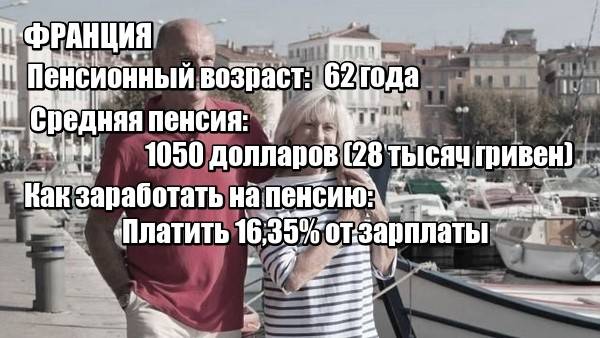

The average pension in France is about 1000 euros. Retired have the right to all the French, however, the more experience, the higher the pension. Monthly salary to the pension Fund take 16,3% (part of this amount is paid by the employer).

In 2013 the French government presented the draft of the next pension reform, which provided for an increase in pension Fund contributions. According to government estimates, this will avoid increasing the deficit to 20 billion euros in 2020.

At the moment the retirement age in France is 62. By the way, the pension system in France one of the most complex in Europe. Now the country has two levels: joint and several and cumulative. The pension Fund deficit resulted from the fact that the life expectancy of the French is growing, with families rarely having more than three children. According to demographic studies, the life expectancy in France in 2040 will increase by four years. As a result, women on average will live to be 88 years old.

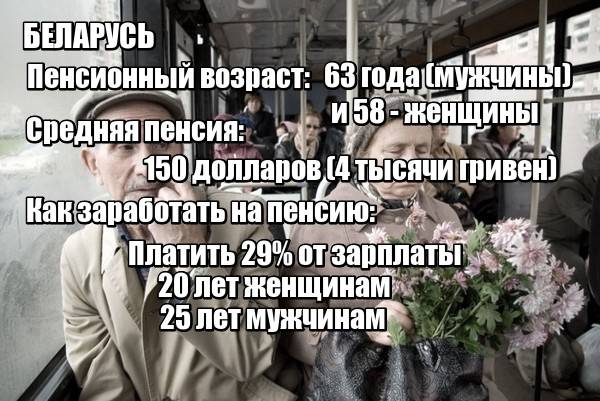

The average pension in Belarus for just $ 150 (that’s two times more than in Ukraine). For the retirement pension, men will have to work at least 25 years and women 20 years. Contribution to the insurance Fund – 29% of salary. While 28% paid by the employer, and only 1% hired employee.

Last year the President of Belarus Alexander Lukashenko has decided to gradually raise the retirement age to 63 years for men and 58 years for women. “The contributors can be employees and their employers. The latter option prevails in most enterprises, irrespective of forms of ownership. Own funds fees pay, usually, persons in self-employment. The size of the required payments for pension insurance remains the same with any method of payment – 29%. When payment of insurance contributions by the employer it accounts for 28% of this amount, and the employee – 1%. The contribution for insurance in case of temporary disability – 6%,” – said on the website of the social insurance Fund.

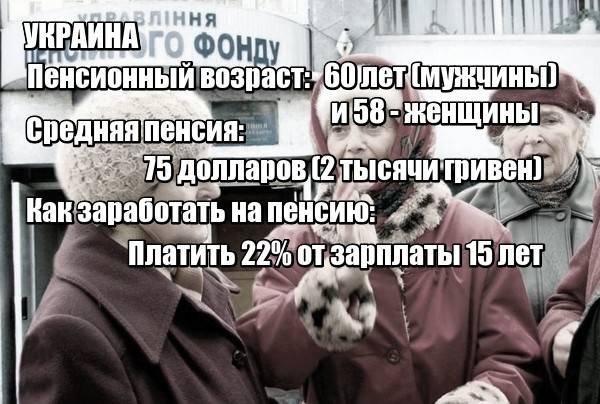

The average pension in Ukraine is less than two thousand hryvnia, and the minimum in may reach 1313 UAH. This amount can eat modestly for a month. Retirees can afford once a day to buy bread, chicken legs and a few times a week cheap cereals and pasta. But personal hygiene remains very tight budget, expensive shampoos, toothpastes with such a pension is not affordable. Besides, even retirees with a subsidy you have to spend money on utilities and travel. The minimum pension will also be enough for exactly 12 trips to the cinema (though it will have to starve, and in a cinema of walking). Also, the minimum pension will be enough to purchase $ 45.

For the old-age pension will need at least 15 years of experience. The amount of the pension depends on the level of salary and number of years worked.

Why Ukrainian pensioners are the poorest in Europe

The main problem of the Ukrainian pension system – low wages. Size social contribution – 22% of salary (in 2015, the rate was at 37%, but from January of last year it reduced) and the lower salaries of Ukrainians, the less money in retirement. Many Ukrainians officially earn the minimum salary – about 40%. The second part of the salaries paid in “envelopes” and taxes are not deducted from it. The decision to raise the minimum wage will add to the “piggy Bank” Retirement Fund of about $ 15 billion hryvnia, but the situation will change is insignificant.

Senior researcher of the Institute of demography and social studies Lydia Tkachenko’m sure the problem of low pensions is the consequence of backwardness of the economy of Ukraine. Low salaries may not be high pension. As noted by an academic, the “backwardness” of the Ukrainian economy can be seen even in the structure of employment – every fourth Ukrainian (3.5 million people) works in sales.

In addition, experts say, the current pension system in Ukraine does not meet the main criterion of fairness. So, the average pension of judges – more than 20 thousand hryvnia, people’s deputies – more than 15 thousand, and more than a million pensioners receive less than 1600 hryvnias. In addition, pensioners who previously retired, gets less money. In 2008, the ratio of length (a measure that is taken into consideration at calculation of pensions) increased from 1 to 1.35, the old pensions are not counted, and new steel assign to the new indicator.

Another problem – 10 employees comprise about 12 seniors. The collected funds are sorely lacking.

We will remind, in may the government will present a draft pension reform. Read more about what will change in the pension system of Ukraine, can be read here.