After nine dreary years of regular decline in GDP growth forecasts macroeconomic authorities around the world in disbelief shake my head despite the wave of political turmoil raised by the populists, in 2017, global economic growth will probably exceed expectations.

And it’s not just the exceptionalism of America. Economic growth in the U.S. is very confident, but in Europe it exceeds the predictions even more. And there’s even good news from developing countries: they continue to prepare for increasing interest rates, the fed, but the conditions for the upcoming adaptation has improved.

A wide picture behind global replacea, easy enough to understand. Deep, systemic financial crises lead to deep, prolonged recessions. Carmen Reinhart and I a decade ago had predicted (and then many scientists using our data, this is confirmed) that periods of very slow growth, lasting 6-8 years, in such a situation are not unusual. Yes, many challenges remain, among them poor banks in Europe, overloaded with debts of the local authorities in China, overly complicated financial regulation in the United States. However, the SEM and a sustained period of strong growth have already been sown.

Will the wave of populism rising in the developed countries, and sink the accelerated economic recovery? Or the economic recovery will help to stop the leaders, who confidently tempting offer simple solutions to really complex problems?

In April in Washington, DC will host the annual meeting of the International monetary Fund and the world Bank — representatives of Central banks and Finance Ministers of the leading countries of the world will come right in the epicenter of the “populist explosion.” Is it possible to doubt that any of them who dare to criticize planned US administration is the rejection of open trade and leadership in the multilateral financial institutions, President Donald trump will turn into a punching bag in his “Twitter”?

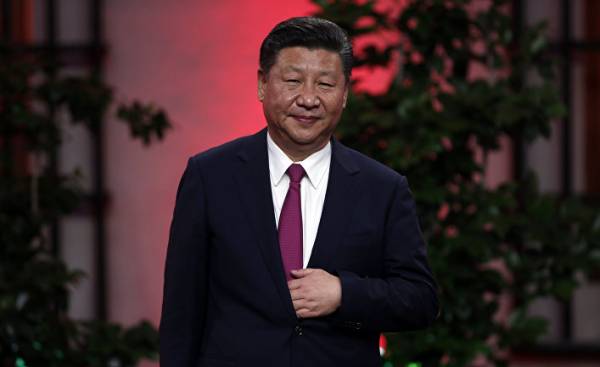

On the eve of the meeting IMF trump will receive Chinese President XI Jinping in his “winter White house” Mar-a-Lago. It is difficult to overestimate how much depends on Sino-American relations, and how destructive the consequences might be if both sides can’t find ways to work constructively together. The administration trump believes that she has the bargaining tools that help to regulate these relations in favor of America, for example, duties on Chinese imports, or even a selective default on US debt to China more than $1 trillion. But eventually this duty will be abolished by the world trade organization, and a default on US debt would be madness.

If trump can convince China to widely open its economy to U.S. exports, and help to rein in North Korea, it will be an achievement. But if his plan is a unilateral refusal of the US global trade, the results of such a policy will hurt many American workers for the benefit of the few.

In Europe, the threat to globalism seem to be weakening: the candidates populists lost the election in Austria, the Netherlands and now in Germany. However, the populist turn in the upcoming elections in France or Italy can still destroy the European Union, which will lead to enormous collateral damage to the world.

Candidate for the French presidency, marine Le Pen wants to kill the EU, because, as she says, “the peoples of Europe do not want it anymore”. And although, according to opinion polls, Emmanuel macron, speaking for the EU, confidently won by Le Pen in the second round of the elections on 7 may, it is difficult to be sure of the outcome of the race, the two candidates, especially given that the President of Russia Vladimir Putin supports Le Pen. An angry electorate is unpredictable, and Russia has proven its ability to manipulate the news and social networks, so it is foolish to believe that the victory of Macron guaranteed.

In Italy, elections are held not earlier than in a year, but the situation there is even worse. The candidate-the populist Beppe Grillo is leading in the polls and is expected to get about a third of the votes. Like Le Pen, Grillo wants to abolish the Euro. It’s hard to imagine a more chaotic event for the global economy, but it is equally difficult to understand what may be the way forward for Italy — per capita income here is even slightly declined during the years of existence of the Euro. As the population grows, and the size of the debt increases (over 140% of GDP), Italy’s economic Outlook looks grim. Most economists continue to believe that the exit from the Euro zone would be for Italy a powerful step toward self-destruction, but a growing number of those who starts to think that the Euro will never benefit the country, and so the sooner she leaves the Eurozone, the better.

In many developing countries have their own populists, and in the case of Poland, Hungary and Turkey, these populists have turned into authoritarian rulers. Fortunately, the patience of the fed, stability (so far) China and economic growth in Europe and the United States will help most developing countries.

The Outlook for global economic growth improve. Provided sound policies the next few years will be much better than the previous. It’s definitely the case for developed countries; and this may be so for most other States. But populism remains an unpredictable “wild”, and only if economic growth will come quickly enough at peak levels, this card can hold out.