In late January, during the round table devoted to the improvement of the mechanism of support of financing of small and medium business in the framework programs of the German-Ukrainian Fund, Ekaterina Rozhkova, Chairman of the NBU, said: “We note the revival of lending, especially in the segment of small and medium-sized businesses. Thus, the quality of loans granted to SMEs is much higher in comparison with loans to other business segments. We believe that this segment will be the engine to restore lending and economic development of the country. In addition, the national Bank is open for proposals of the market, which can help to revive lending to the Ukrainian economy.”

In fact, such proposals the Bank received and gets a lot. Not enough, perhaps, only the desire to implement them in a more or less significant part. As for the attitudes of banks to lending, the NBU also know, because on a quarterly basis carry out the necessary surveys. The most recent of them took place from 21 December 2016, 16 January 2017, it was attended by credit managers 64 banks, whose share in the total assets of the banking system is 99%. The report provides an assessment of the credit market in the fourth quarter of 2016, expectations for the first quarter and the entire 2017

The corporate sector

Banks expressed an optimistic hope for change key indicators of the sector over the next 12 months. For the first time since the end of 2015, the respondents expect growth in corporate loans, reported by 71% of respondents. To improve the quality of the loan portfolio, I hope the 49% of respondents. 77% predict a further influx of deposits, primarily from corporations.

For the third consecutive quarter, banks predict an easing of lending standards in the corporate segment. In q IV such expectations increased significantly for all types of loans. For the first time since the end of 2013, banks are talking about a possible easing of credit standards for foreign currency loans.

Similar to the expectations expressed by the banks in previous quarters, did not come true: respondents continue to indicate the persistence of lending standards in General. Preserved the standards of granting short-term loans, hryvnia and SMEs. The standards have become more stringent for loans large enterprises, long-term and currency. Increased competition among banks and expectations of economic growth were the main factors affecting the internal standards and criteria that banks have in lending policy.

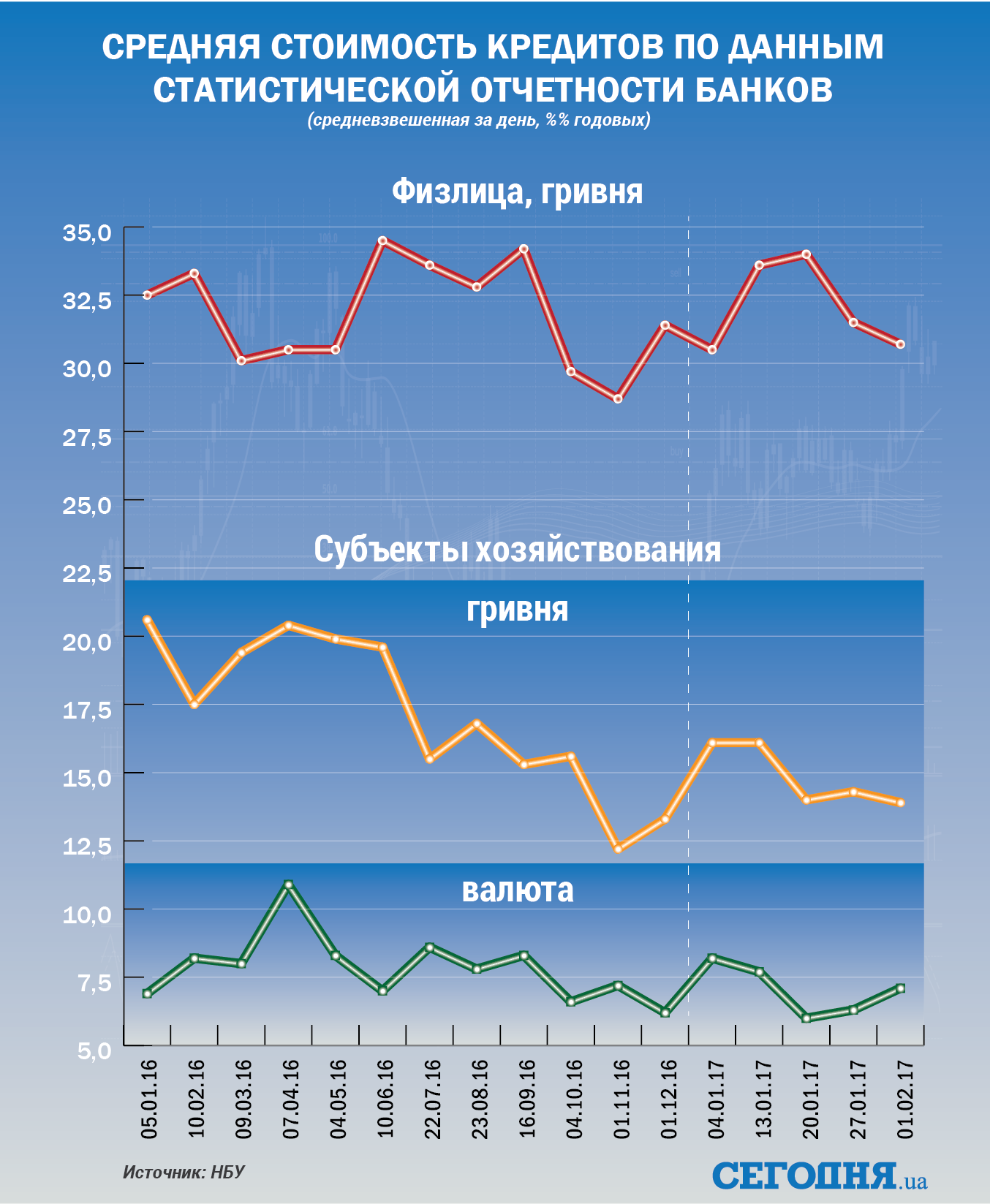

The main factors that restrained the growth of credit portfolios, were the internal requirements of the Bank credit agreements, collateral requirements, maturity and size of loans. The decline in interest rates and the need of enterprises in working capital were the main factors in the growth of demand for loans throughout 2016.

In the next three months banks predict a rise in demand for all types of loans, except for currency.

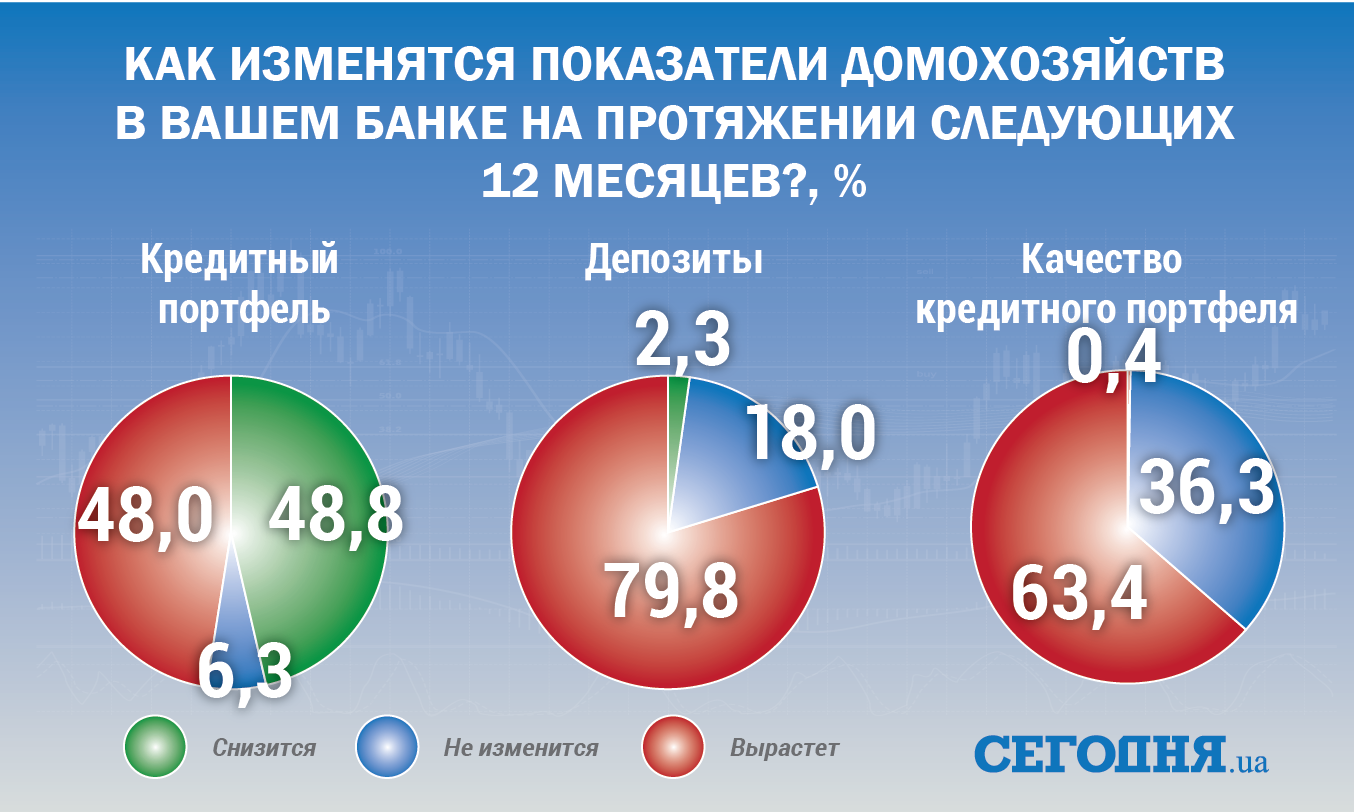

The household sector

In q IV standards for consumer credit were eased – this trend continued for a year and a half. In mortgage lending standards diminished considerably after remained almost unchanged during the first three quarters of 2016, Banks predict a further easing of standards for consumer and mortgage lending in the first quarter of 2017.

The weakening of lending standards households, the greatest impact of increased competition and lower prices for the resources.

Banks noted that in q IV made more requests for mortgage and consumer loans. Loans to households continued to fall in price. In consumer lending softened non-price terms and conditions – the terms and amount of the loans.

The demand of households for loans has continued to grow. The main factor increasing the demand for mortgages had lower rates. Consumer confidence, growth of household savings and the increase in expenditure on durable goods were the main drivers of growth in demand for consumer loans.

In the first quarter of banks expect growth of demand for more consumer loans than on mortgage.

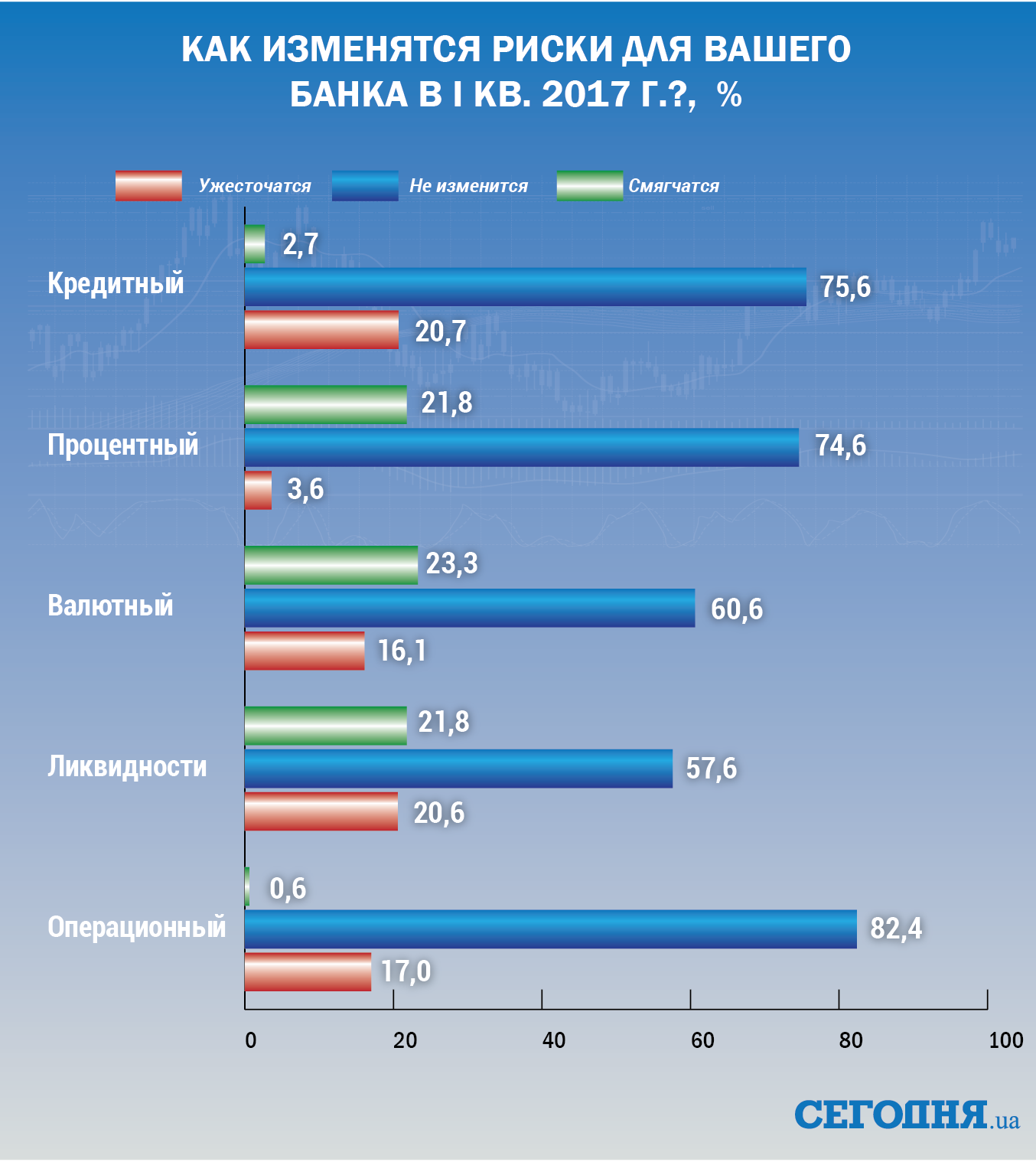

Expectations of changes in the level of risk

Banks have reported increased risks in the fourth quarter To a significant extent, this was influenced by a reassessment of the risks of individual large banks, which were more optimistic in the first three quarters of 2016.

For the first half of the year increased liquidity risk. A significant increase in credit risk stated by 19% of respondents. Contrary to the expectations of reduction of interest rate risk in the fourth quarter of 23% of banks reported an increase. Due to fluctuations in the exchange rate of hryvnia, which took place in the days of the survey, increased, according to banks, the currency risk. Operational risk increased slightly.

In the next quarter and in the future, banks expect that credit and operational risks will increase. The projected reduction in interest rate and currency risks in the first quarter of 2017, despite the growth of these risks in the fourth quarter of liquidity Risk, according to the forecasts of banks that will not change.