Fraudsters last year “earned” Ukrainians almost 340 million hryvnia, asking the credit cards. According to the Ukrainian interbank Association of “EMA” in 2015, the revenue of the attackers were four times lower. Increased and the average amount of fraudulent transactions. The website “Today” to understand how crooks swindle money from the people and how to “save” their money.

“According to the survey, 77% of Ukrainians know not to disclose secret data of your card, but most people when talking with a scammer transmit this information and lose money,” – says the Chairman of the Board of First Ukrainian International Bank (FUIB) Sergey Chernenko. According to EMA, last year grew a record number of fraudulent sites (from 38 to 174). These pages on the Internet, criminals use to obtain personal information about the customer and credit card data. However, according to the national Bank, most Ukrainians themselves disclose personal data to fraudsters.

“In recent times cyber criminals call users of payment cards, called the representatives of the National Bank of Ukraine and demanding to be called confidential information about the details of a payment card, amounts of balances on accounts or passwords to online banking and so forth,” – said the NBU.

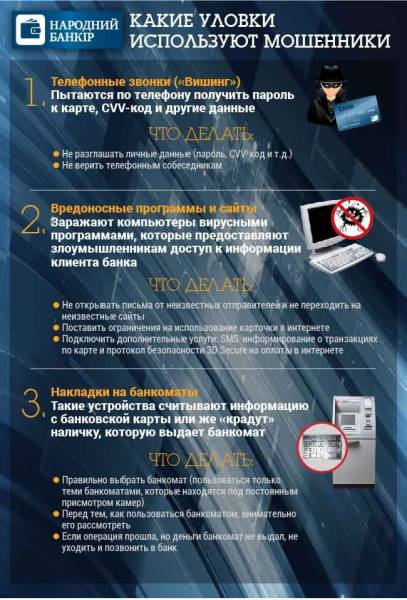

In Ukraine, the common five methods of fraud with Bank cards, tell the Bank FUIB: vishing, malware, phishing, skimming and lining for cash.

Vishing (vishing – voice phishing). Scammers are calling to a mobile number of a Ukrainian, previously gathered information on social networks, directories or other sources. On the phone, the criminals try to know the password of the card number, CVV code (last three digits on the back of the card).

According to experts, the banks never ask for confidential information. Attackers may even try to seize the mobile phone number that is bound to a Bank card, to give him his own. This Scam involves operators, say that lost access to the phone and asked him to restore it. Pre-attackers can transfer on your phone bill a small amount of money or make a few calls. If the mobile phone joined is unknown, experts suggest to call the operator and tell about it.

What to do:

Not to discuss with “Bank staff” on the phone all credit card information. The Bank employee will never ask for pin code from the card or the CVV code, also the phone can not perform any actions with the card.

Not believe telephone interlocutors. Scammers may claim that if not specified, card will be blocked or will be charged some money. In such a situation, better self call your Bank (number on the card and the Bank’s website). After a questionable call immediately contact the police. The police recommend, do not immediately deny the fraud, and ask them to call back later. At this time you need to inform the police about the conversation. This will help to identify and apprehend criminals.

“If someone on the phone asks you for information about the map, just stop the conversation. If you sent an SMS that your card has been blocked or you have made a payment, which you do not know – do not respond. If you want to check it out – should only call on the official phone of the customer service center of the Bank that is listed on your credit card or online Bank on the Internet”, says Serhiy Chernenko.

Malware sites (phishing from the English word fishing — fishing). This is one of the most common fraudulent means, talk to experts in FUIB. Attackers of computer viruses possess sensitive data. Virus can sent to the postal address, or send a link to the “infected” website.

After the actions of malware, the fraudsters can gain remote access to the user’s computer and transfer funds. FUIB note that now the scammers have started to use security certificates HTTPS version to mask their sites for reliable.

According to estimates, “EMA”, one fraudulent service can visit (and to leave details of their credit cards), an average of 800 users per day. Record – 2600 users.

What to do:

Not to open emails from unknown senders and do not go to unknown sites. If you go to a malicious website, the virus will load automatically. So do not open emails from unknown senders or clicking on unknown links, even if they send friends on social networks. As experts explain, the accounts of the Ukrainians in social networks, Skype and other means of communication can capture the attackers. After that, your account will be sent emails with links to virus.

Put limits on the use of the card on the Internet. This can be done independently in online banking. You can set limits on transactions on the Internet, ATMs and outlets. If you pay the Internet often, order another Bank card specifically for online transactions.

To connect additional services: SMS-informing about transactions on the card and the security Protocol 3D Secure. Then each separate transaction in Internet will be acknowledged with a separate password on a mobile phone.

Skimming (skimming off foam). It’s different overlays on ATMs that read the information from the magnetic strip of the card. Then, on the basis of these data, attackers make fake cards or sell the details obtained on the Internet. Pads can be small in size, untrained customer to spot them is very difficult.

Also scammers use the cache-trapping (cash-trapping – capture of cash). That’s the bar with Scotch, which the fraudsters glued to the window of the issuance of money in the ATM. Ukrainians, ordering tools, expect them, but money doesn’t just appear – they stick to the tape and are in a window of delivery. The victim perceives it as a problem ATM. Sometimes even moving away from the ATM, but don’t call the hotline of the Bank. But the scammer simply return to the cash machine and tearing the bar to collect the funds.

What to do:

Choose the right ATM. Experts advise to use only those ATM machines that are under constant supervision of CCTV cameras in supermarkets, Bank branches near large stores.

In places where many people are constantly working the camera, and especially where the ATMs close at night in the room, the scammers and less risk to install the plate and the device to read information from the cards.

Before you use the ATM, be sure to consider it. If you noticed the plastic trim or is suspected, the ATM is better not to use it. Also you should contact the support service of the Bank.

If the operation was successful but the money the ATM did not give, not to get away from the ATM. Immediately after this you need to call the Bank’s customer support and find out why the ATM did not give cash.

Experts advise Ukrainians who fall for scams, to register an appeal on the website of postal and telecommunications cybercrime.gov.ua as well as post information on the website “EMA” http://ema.com.ua that others were not injured.

The program “people’s banker” on Tuesdays at TRK “Ukraine”. Want to become the hero of the story? Ask us a question on [email protected]

PJSC “FUIB”. Us ViDi banksky of the hotel. Bankseta Board of the NBU No. 8 from 06.10.2011 R. General Board of NBU № 8-2 from 12.02.2015 R.