The electoral success of the party of justice and development, President erdoğan for a long time due to good indicators in the economy. However, the devaluation of the Turkish Lira, slowing growth and increasing unemployment cause the deterioration of the situation and can lead to loss of the votes of the supporters of changes on scheduled for the 16 April referendum on the Constitution.

As they say, the Turkish voters vote the portfolio. Only now that the economic growth that has known the country for the coming to power of Islamic conservatives in 2002, are no longer visible. And this may be reflected in the referendum of April 16 on the proposed power of constitutional reform.

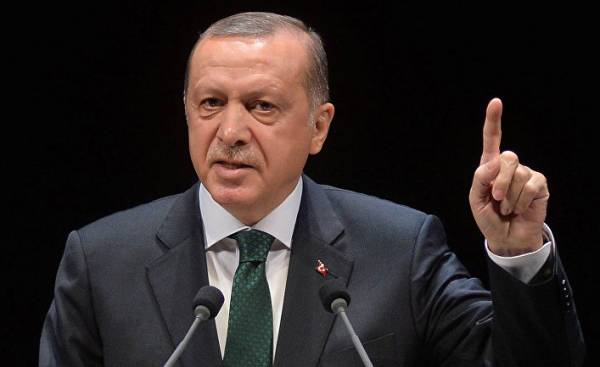

In seeking to support the national currency, President Recep Tayyip Erdogan appealed to the public. “Let those who is the currency under the pillow, will pay it in gold, Turkish Lira”, — he said in early December. Anyway, at the end of March devaluation was 25%, thus confirming the loss of value of the national currency against the dollar.

2016 issued for the Turkey is very heavy. In the third quarter, which was a failed coup d’etat of 15 July, GDP even fell by 2% for the first time since 2009. Anyway, overall growth for the year was 2.9%.

Ghost 2001

“Be careful: the Turkish growth performance is deceptive,” — said the economist Deniz Akgul March 28 at a seminar at the Centre for international studies of the Paris Institute of political studies. He recalled that since the 1950s, the annual average economic growth in the country is 4.8%, but from 2012, is significantly below this level (2.1% in 2012 and 4.2% in 2013 and 3% in 2014 and 4% in 2015). That is, the Turkish economy is experiencing a recession.

In addition, hovering over all and the Ghost of depression. Over 20 years in the Turkish economy there are three of them. In 1999, the Turkish GDP lost 3.4% because of the August earthquake in Istanbul. In 2009, the source of the problem became a global crisis. Finally, the depression of 2001, the only associated with internal causes led to the decline in GDP is 5.7%.

Model PSR limited time

“Until 2008, Turkey was able to present to foreign investors a beautiful story, explains Denise, Cahul. — In fact, most of the economic reforms was not adopted by the current government Islamo-conservative, and a previous center-right coalition at the initiative of Kemal Dervis”.

Newcomers have had the sense to keep a tight budget control by the IMF recommendations and not return to the populist practices, which were the cause of crises in coalition governments.

Inflation was brought under control and dropped below 10% since 2003, after almost 90% in 2001. Reform, neighbourhood policy, the recognition of Turkey’s EU candidate country in 1999 and the start of negotiations in 2005 — all this created the conditions for a massive inflow of foreign investment. In the period from 2002 to 2007 the volume of foreign direct investment in Turkey has increased by 20 times, from 1 up to $ 20 billion. Turkey’s share in international capital flows increased from 0.1% in 2001 to 1% in 2006.

From 2002 to 2007, Turkish GDP grew by 40% in real values. Although the distribution of wealth has not improved, economic growth and the end of the period of hyperinflation significantly reduce poverty in the country (the number of people with income less than 4.3 dollars per day decreased from 30% to 7% from 2002 to 2007), writes the economist Ahmet Insel in the book “the New Turkey of Erdogan”. The AKP has strengthened its influence among the poor, a new middle class.

Back to Europe

The global crisis of 2008, “at first plunged the Turkish economy into a depression, but then opened a great opportunity to Finance the external deficits of Turkey with the mass involving the Federal reserve and the European Central Bank with unprecedented low interest rates,” notes Denise Akgul.

This unexpected event helped to disguise the decline in the attractiveness of the Turkish economy in connection with the termination of structural reforms, which was explained by the distancing of the European prospects and the formation of the doctrine of “strategic depth” of Turkish foreign Affairs Minister Ahmet Davutoglu (he later became Prime Minister until may 2016).

Since 2009, “Davutoglu put unrealistic task to replace Europe, the Middle East and Turkey’s neighbors in trade,” — emphasizes the Denise Akgul. Risky (and yet lost) bet in connection with the war in Syria, bad relations with Egypt under the leadership of Fatah al-Sisi and destabilization of Iraq.

A chronic disease of the Turkish economy

Turkey has always had a negative current account balance, however, it increased significantly: from 0.6% of GDP in coalition governments in the 1990-ies up to 5.3% of the AKP. In 2011, the deficit reached a record high since the founding of the Republic in 1923: 9,6% of GDP. Denise, Cagul calls it a chronic disease of the Turkish economy. Economic growth in the country relies on household consumption, while exports cannot fix the trade balance due to the small value added Turkish products.

Without access to the savings of the population of the Turkish economy desperately needs foreign capital to compensate for negative trade balance and private funding. Now same period, the available currencies, apparently, comes to an end, and the recent devaluation of the Lira only reflects this chronic disease the national economy.

Although in 2015, the external debt of Turkey amounted to only 32% of GDP (an average of 85% in Europe), a devaluation increases government guaranteed payments to foreign investors. Turkish economist Mustafa Sönmez wrote on March 29 on the website Al Monitor, how expensive large-scale projects of Erdogan, foreign sponsors which you want to return the money in dollars. The expert mentions in particular outdoor this summer, the bridge of Osman Gazi over Izmir Bay. In 2017 it will increase public spending by 1.6 billion pounds, largely because of the decline in value of the national currency. These large-scale construction projects, the material symbol of economic progress under the AKP in the eyes of the electorate, can turn into a financial pit for the Turkish state.

The loss of investor confidence

Now the main source of threat is the withdrawal of the foreign capital, recalls Denise, Akgul: “In 2015, the need of the Turkish economy in financing accounted for 25% of GDP. 21% for maintenance loans and 4% to Finance the deficit”.

If economic growth suffocates, and the Lira will continue to depreciate, foreign capital will begin to withdraw from Turkey as I will not be able to count on equally favorable return on investment. In addition, the recommendations for investments in Turkey, BNP-Paribas notes that among the main weaknesses of the “uncertainty of the exchange rate”.

Political purges are also a source of concern for foreign investors. According to Turkish economists, they regularly ask such questions. Whether 130 thousand civil servants to challenge the dismissal or removal, as well as to unpaid salaries after the introduction of state of emergency? How will the elimination of the 800 enterprises that were the target of suspicion in the support of gülen and was seized, and by order of the authorities and not the court? The same applies to associations, foundations and schools, which account for 3-4 billion dollars. The total amount of expropriated property is $ 15-20 billion.

The situation prompted Moody’s to drop in September long-term rating of Turkey to “speculative” level. Among other criteria, it was noted the deterioration of security of private property.

Growth, employment, inflation, and… newsletter

On the employment front, “the rise of unemployment could affect ratings, says Denise, Cahul. — It was 8.1% in coalition governments, and rose to 10% when the AKP. Later, the number of unemployed increased from 3,057 to 3 million, 330 million from 2015 to 2016 (3.7 million in December 2016, according to the adjusted data seasonally adjusted)”.

The success of the AKP in the elections relied heavily on the economy. Therefore, due to the deterioration of the image of Erdogan may be seriously affected. Anyway, it takes time, and not the fact that it will last until April 16.

In any case, Turkey will not be able to avoid an economic adjustment in the coming years, under the leadership of the government or under pressure from international lenders of the country. The second option is clearly on the hands of President Erdogan: he can shift to “foreign powers” responsible for the victims of the Turkish people.