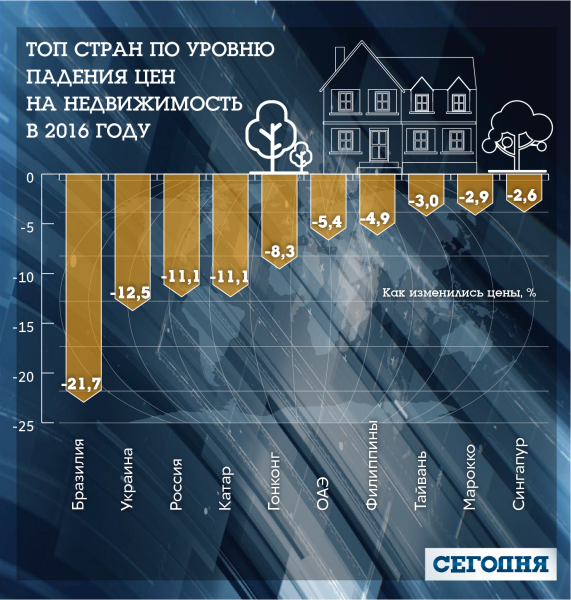

The situation on the real estate market is a litmus test for the country’s economy, experts say. The last few years, housing prices in Ukraine, a record fall. According to international research Global House Price Index, the level of decline for the 2016 first in the world ranked Brazil and the second – Ukraine. This year, property prices fell another 2%. The real estate market is directly linked to purchasing power, despite falling prices, the majority of Ukrainians still cannot afford to buy their own homes – mortgage lending practically is not working, and save up for housing with an average salary impossible. The website “Today” figured out what was happening with the Ukrainian real estate market and when prices rise.

What happens

The real estate market began to fall in Ukraine in 2008, says the head of the Committee of the Association of realtors Edward brazas. In 2012 the situation began to stabilize, but after two years, the market encountered a record drop. In 2014, apartment prices in dollar terms fell 2% on a monthly basis. Reasons for the decline in prices a depreciation of the hryvnia, the decline of purchasing power of Ukrainians, the unstable situation in the East of the country.

At the moment prices are down about 0.5% on a monthly basis to talk about any growth before, I’m sure Edward brazas. “The rate of decline has dropped significantly. This is the first encouraging sign. The second sign – the commercial property market, primarily for trade, feels good. This segment is most quickly responds to the mood of the consumer, the solvency of the population. Sellers continue to complain that their turnover is falling, but the number of vacant premises, as in triticale and professional platforms is reduced,” – says the expert.

“The rate of decline has dropped significantly. This is the first encouraging sign. The second sign – the commercial property market, primarily for trade, feels well”, – says the expert.

See ALSO: in Ukraine save up for an apartment

Prices for “secondary housing” – in dollars, like the realtor Maxim Baborak. Even with the lower prices in the foreign currency equivalent, in UAH real estate has risen. “In 2013, the average price of a Studio apartment in Kiev was 60 thousand dollars. At the rate of eight it was 480 thousand. Now the average price for “odnushku” 48 thousand dollars, but at the rate of 26 is already 1.2 million. Of course, when people zarabatyvayut in UAH to buy an apartment after a devaluation – is very difficult,” – says the realtor.

First place in the world in terms of falling prices took Brazil. Last year the apartment there are 21.7% less. At the moment odnushku in the capital of Brazil can be bought for 72 thousand dollars, which is about 36 the national average wage. In Kiev, says realtor Maxim Baborak, one-bedroom apartment can be purchased for 48 thousand dollars is a 189 average Ukrainian salary.

What will happen to prices

“If the situation develops so, as of now, with a small growth of 1-2% per year, then talk about the growth in property prices is not necessary. You can only talk about stabilization. I think that the pace we have in the next few years in the regional centers will stabilize, a slight growth of one percent. In smaller towns the decline will continue, people leave, demand falls,” says Edward brazas.

Maxim Baborak also assumes that next year prices could rise by 5% for the year assuming stable economic and political situation.

“The market reacts at all. Escalation of hostilities in Donbass – people cancel the transaction, I’m afraid to invest in real estate, fell the hryvnia exchange rate – the demand for apartments is falling,” – said the realtor.

According to experts, the only way to stabilize the situation on the market is to achieve stable economic growth. In addition, Ukraine must earn mortgage lending. Now the average mortgage rate more than 20% per annum. The banks are in no hurry to give the customers of apartment on credit. Mortgage unable to only reliable customers with good credit history and not every Ukrainian Bank.

Edward brazas sure that the mortgage must be a rate of no more than 13-15% per annum, then only such an operation can truly be called a “mortgage.” “Above that figure – it is not lending. When this happens, it is hard to say,” – said the representative of the Association of realtors.

For example, in USA interest rate on the mortgage can vary in the range of 3-5% (dependent on amount of initial payment and the duration of the loan). While in Ukraine you can get for no longer than 15 years, in the US, the mortgage can be paid back in 30 years.

“Now housing with an average salary can not buy. When will be the situation that three years to defer the salary is enough to buy an apartment, then the market will flourish. Or if we have normal conditions on the mortgage. If you can take the apartment even at 10% per annum, I’m sure the demand will soar,” says Maxim Baborak.

See ALSO: When Ukraine will return the mortgage

By the way, according to the budget resolution until 2020, the Ukrainian economy next year will increase 3%, in 2019 – 4%, and in 2020 – 5%. And the world economy in 2017, according to the IMF forecast, will increase to 3.6%. If both projections are correct, next year Ukraine will increase the gap by 0.6%.